Economic recovery, vaccine and portfolio considerations

Key Observations

Financial assets produced remarkable returns over the final nine months of 2020, characterized by rising equity valuations and narrowing credit spreads amid a global pandemic and a disjointed global economy.

The global economy is poised to achieve strong year-over-year growth and modest inflationary pressures in the first half of 2021, which should benefit risk assets and spread sectors. Wide-scale vaccination efforts may be the link to more sustained economic growth as the year progresses.

While it is uncertain if the market rotation that began in November will continue, we advise maintaining broad diversification within and across asset classes to ensure a portfolio does not unnecessarily hinge on any one economic outcome.

Financial Market Conditions

Economic Growth

Although global economic activity picked up in the second half of 2020 as economies emerged from strict containment measures, the pace of recovery may be poised to moderate sequentially (quarter-over-quarter). Policymakers remain vigilant against COVID-19, reinstating mitigation measures in some areas (e.g., Illinois, New York and Massachusetts) until vaccination efforts are able to play a more active role on the public safety front. Although the pace of economic growth is likely to slow quarter-over-quarter, year-over-year economic and earnings growth should rebound sharply in the first half of 2021, particularly in the second quarter. However, our base case expectation for 2021 is best described as a tale of two halves, distinguished by uncertainty about the ultimate pace of economic normalization.

Monetary Policy

Global central banks remain committed to using all tools necessary to reinforce the ongoing economic recovery and achieve policy objectives. Apart from temporary programs designed to alleviate financial hardships caused by the pandemic, the Federal Reserve, European Central Bank and Bank of Japan all reiterated plans to maintain asset purchase programs until individual economies meet their respective policy objective(s). That may change in 2021, should the bifurcation between monetary and fiscal policies diminish.

Fiscal Policy

The exogenous shock caused by the global pandemic exposed the limits of conventional monetary policy measures, which take time to work through economic channels and largely remain stuck in the financial sector, and pressured policymakers to respond decisively with unprecedented deficit spending. In the U.S. alone, the fiscal deficit grew $2.8 trillion from March to November as Congress attempted to ease private sector financial conditions hit hardest by lost income (1). Janet Yellen, President Biden’s nominee for U.S. Treasury Secretary and former Fed Chair, is familiar with the limits of monetary policy absent coordinated fiscal policy. Her nomination signals a potential merger between the Treasury and Fed to deliver targeted accommodation to the private sector if the economic recovery should slow.

Inflation

Through November, the Fed’s preferred year-over-year inflation measure, the Core Personal Consumption Expenditure Price Index (“PCE”), remained stubbornly low at just 1.4 percent (2), and long-term broad inflation expectations remain well-anchored. However, the impact of pandemic-induced stimulus and ongoing measures to alleviate the economic burdens on households (evidenced by a deceleration in the labor market recovery) may cause inflation to rise in 2021.

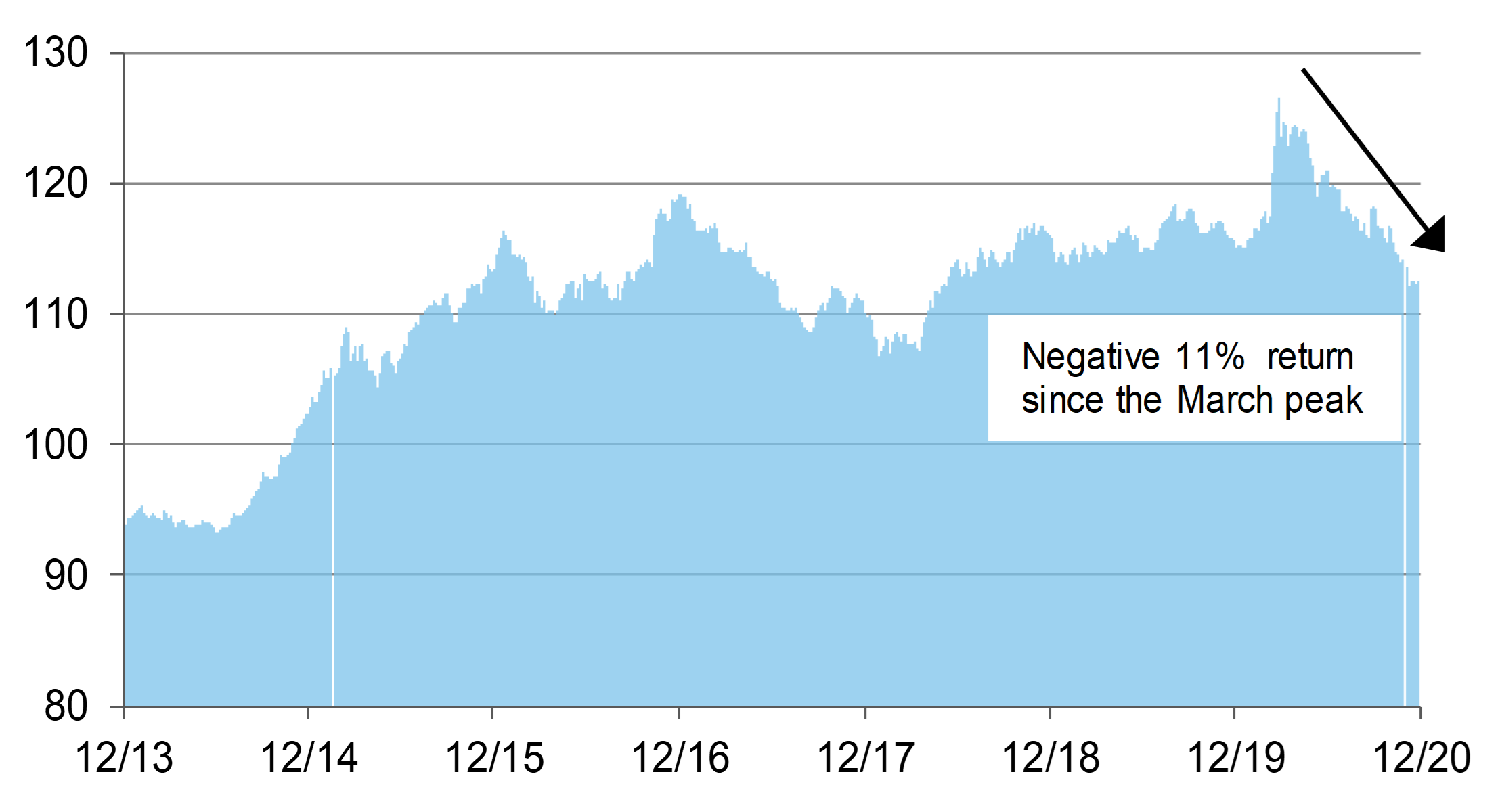

Currency

Following its dramatic run-up in March as investor appetite for risk plummeted, the trade-weighted U.S. dollar fell nearly 11 percent by late December (the year-over-year decline was a more subdued 3 percent) (3). In 2021, the U.S. dollar may continue to encounter downward pressures given the current configuration of domestic monetary and fiscal policy, which could ignite opportunities (and higher valuations) in tangible assets and international equities for U.S. investors.

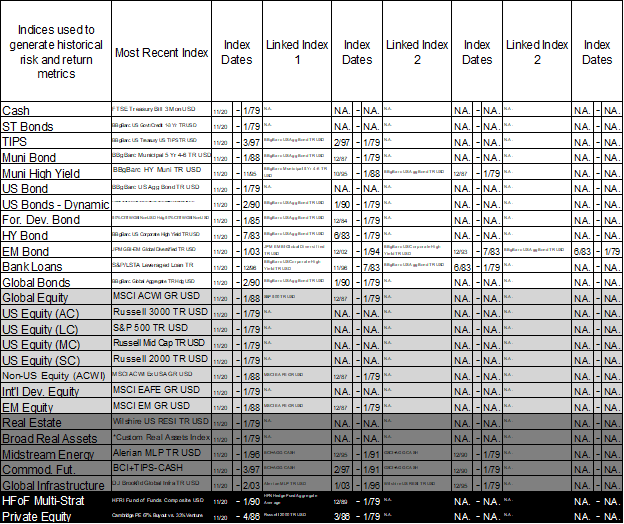

DiMeo Schneider 10-Year Capital Market Assumptions

The resiliency demonstrated by capital markets during the last nine months of 2020 was remarkable and certainly welcomed by investors in an otherwise challenging year. Gains achieved across many asset classes influence and inform our most recent efforts to recast our capital market expectations, and elevated valuations inhibit our forward-looking return assumptions. The table below summarizes our 10-year return estimates and demonstrates the higher hurdle (and lower expected returns) that are by-products, largely, of the last three quarters’ worth of strong risk asset returns.

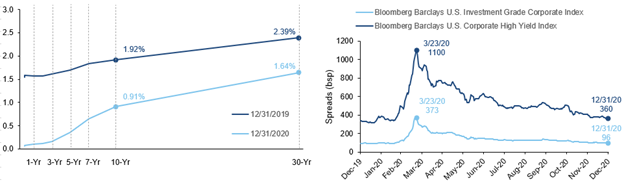

The Federal Open Market Committee (FOMC) took its policy interest rate to zero in the first quarter of 2020 (4), which drove bond prices higher and subsequently reduced our return expectations across fixed income. Our bond return expectations are further constrained by credit spread levels, which narrowed from April through December on reopening optimism and demonstrable progress toward a vaccine. Strong global equity returns

in 2020 resulted in elevated equity valuations to start 2021 and lowered our equity return expectations 0.3 to 1.6 percent.

We have also reduced our return expectations for real assets and alternatives, although these asset classes continue to offer important diversification benefits within a thoughtful portfolio construction exercise. Changes to hedge fund and private equity forecasts are tangential to changes in public fixed income and equity return assumptions.

Our latest capital market forecast generally calls for lower returns relative to prior years for stated volatility targets. As such, investors should review portfolio compositions with a particular and elevated focus regarding their capacity to assume risk and be guarded in their efforts to source returns in what, we suspect, may be another eventful year in the capital markets.

Investment Themes for 2021

Financial market conditions as 2021 begins are book-ended by a wholly unique set of circumstances inescapably linked to global efforts to remediate the pandemic. Unprecedented levels of stimulus had the immediate effect of stabilizing markets and elevating investors’ risk appetite, yet vaccination dissemination programs remain nascent and somewhat fragmented. While we expect these factors will continue to govern and sway investment markets near-term, we are cautiously inclined to favor thoughtful exposure to risk assets as the New Year starts. As we highlight below, we are encouraged by the increasing breadth of asset class returns witnessed in the fourth quarter of 2020 – a precursor, perhaps, to the advent of a new economic regime exemplified by more sustained and synchronized levels of global economic activity. Wide-scale and effective vaccination distribution necessarily coincides with this expectation.

1. The Pandemic’s Wake

Key Observation Beginning 2021 – Before the development of a COVID-19 vaccine, the period of social, emotional and economic adversity seemingly had no end in sight. Though early bipartisan legislation offered financial relief to households and businesses, incremental fiscal stimulus was mired in political gridlock until late December. In many ways, the advent of a vaccine from global pharmaceutical companies (e.g., Pfizer, Moderna and others expected in 2021) offered a glimpse of a path forward. Vaccine development and distribution efforts, once they fully take hold, boost the likelihood of harmonized economic growth normalization in 2021. Importantly, there is ample historical precedence evidencing a broadening pattern of asset class returns as the global economy finds its footing, generates momentum and begins to navigate a path to more sustained growth. As highlighted below, activity in the markets in the fourth quarter of 2020 may offer a first hint for this potential moving forward.

Small cap and value-orientated equities produced substantial returns in the fourth quarter, improving market breadth heading into 2021.

Portfolio impact – The strong rebound in equity valuations following the first quarter sell-off in 2020, while certainly welcome and encouraging, did not entirely eradicate the relative dislocations across certain segments of the domestic equity markets. We expect relative performance between the growth and value styles will likely mean-revert over time and that recent tailwinds favoring growth equities may serve as headwinds in 2021.

Though not impossible, it is difficult to imagine how this year’s much championed “stay-at-home” stocks could replicate growth rates on a year-over-year basis in the face of (1) tough 2020 comparables (2) improving coordination on the vaccine distribution front and (3) a footprint of broadening economic growth. Outcomes across the capitalization spectrum take their cues from where within the cycle the economy resides and, consistent with our baseline forecast that we are early in the next cycle, suggest that small cap stocks may be poised to sustain the return advantages they generated in the fourth quarter of 2020. As always, we advocate that maintaining broad diversification within and across asset classes most effectively ensures that a portfolio is not overly exposed to any single economic outcome.

2. Opportunities in a Low-Interest Rate Environment

Key Observation Beginning 2021 – Global central banks responded to the pandemic swiftly by slashing policy rates significantly – to zero in many cases. The quick response supported the functionality of global financial markets, staved off deflationary forces and bolstered the financial sector. The corollary is that fixed income return expectations on a go-forward basis are necessarily diminished. Entering 2021, investors must now contend with historically low return estimates from many traditional fixed income asset classes (e.g., sovereign bonds, investment-grade corporates and high yield debt).

Low-interest rates and tight credit spreads portend lower forward-looking returns in traditional fixed income

Portfolio impact – Historically low interest rates, uneven global economic recovery and the potential for modest inflation volatility necessitate a particularly attentive fixed income allocation as 2021 begins. Investors may want to consider how, for example, dynamic bond strategies fit within a portfolio as a means of navigating the current backdrop. These strategies customarily invest widely across fixed income markets, often seeking opportunities in more nuanced bond segments while typically possessing lower sensitivity to interest rates. Expect nimbleness and selectivity to be key attributes needed in the quest for fixed income returns this year.

3. A Case for Global Equity Exposure

Key Observation Beginning 2021 – Stay-at-home efforts to contain the spread of COVID-19 was the impetus for sharply increased demand for productivity and entertainment solutions. These service providers, many in the technology sector, were rewarded with impressive earnings growth and handsome returns in 2020. However, as vaccines lay the groundwork for more normal economic activity, companies hit hardest by the pandemic could experience dramatic earnings growth in 2021 and a continuation of the advantaged returns that were witnessed in the fourth quarter of 2020. As we outlined earlier, those equity sectors and styles that lagged during the financial market recovery, such as small cap and value equities, produced strong returns in November and December. International equity markets produced advantageous returns as well as 2020 drew to a close.

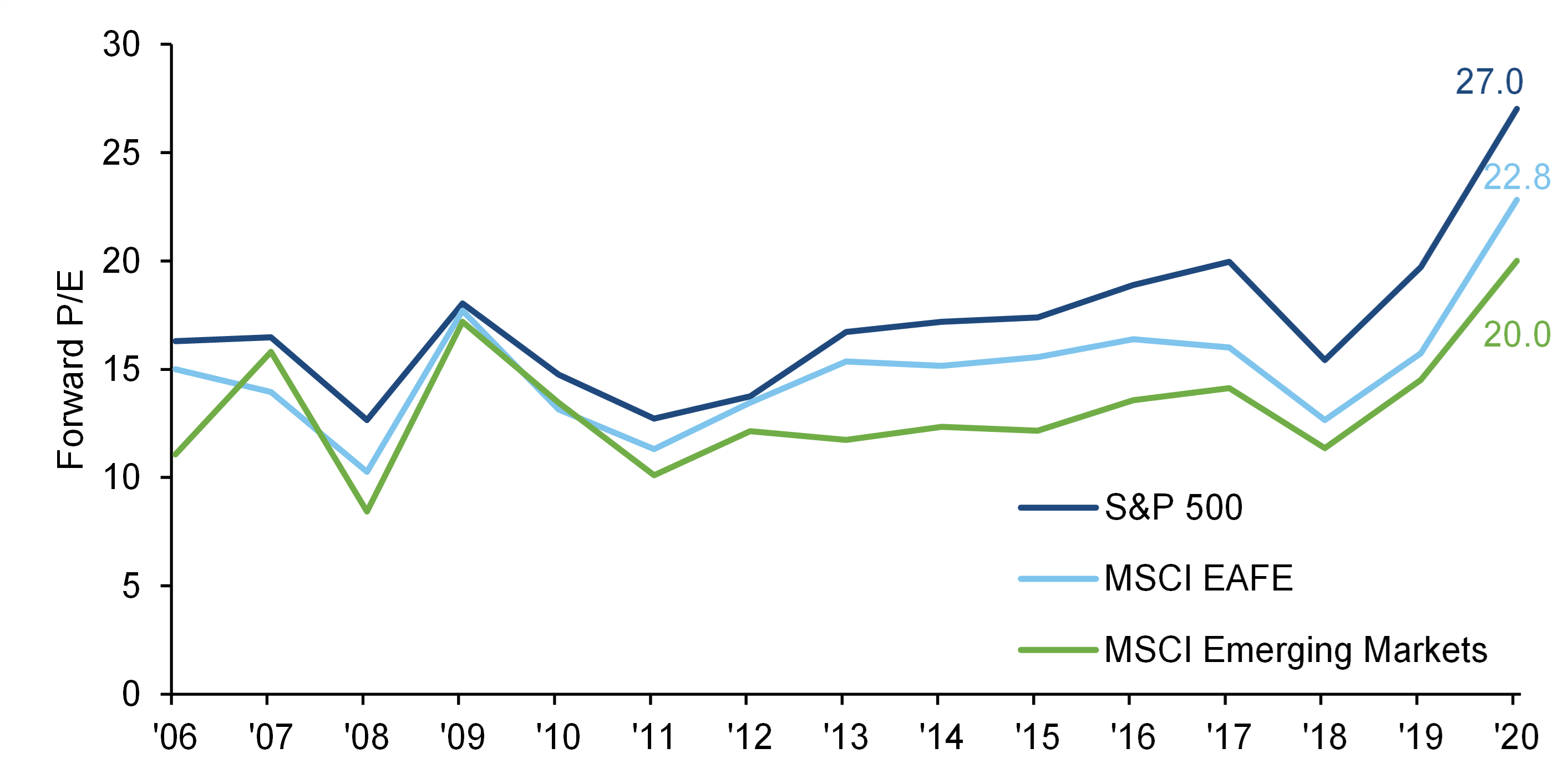

Relatively more attractive international valuations and the prospects of further U.S. dollar weakness support the prospects of international and emerging market equities.

Portfolio impact – Equities are inherently more sensitive to economic growth and rising inflation than bonds. While we are mindful of elevated valuations, an economic recovery, prospects for further weakness in the U.S. dollar and stability within the commodity complex elevate prospects for international developed and emerging market equities. As highlighted above, relative valuation advantages persist across wide swaths of equity markets overseas, and the inherent composition of many of these markets also postures more favorably to a prolonged global economic recovery.

4. Returns from Real Assets

Key Observation Beginning 2021 – Despite extraordinary measures on the monetary stimulus front, official inflation measures have remained stubbornly low over the last 10 years. Core Personal Consumption Expenditures (“PCE”), the Fed’s preferred inflation measure, averaged just 1.6 percent during this timeframe – well below the stated 2 percent target (5). We attribute much of the disconnect to two forces. First, monetary stimulus is susceptible to clogs in the financial sector and disproportionately benefits financial asset inflation over inflation in real assets (for more information, please see our Inflation Framework video). Second, continued U.S. dollar strength over the last six years has weighed on raw material prices.

However, increased emphasis on fiscal policy, precisely those policies aimed at putting money directly into consumers’ hands, can raise the velocity of money and buoy inflation in real assets. Increased federal deficits, paired with the Fed’s $1.4 trillion annual asset purchase program, may set the stage for a secular decline in the U.S. dollar.

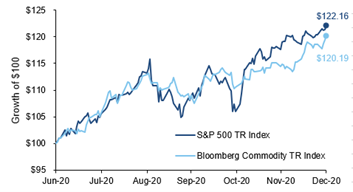

Fiscal policy, in coordination with existing monetary policy, put downward pressure on the U.S. dollar…

…which benefitted commodity prices in the second half of 2020.

Portfolio impact – Over the last ten years, U.S. dollar strength disproportionately benefitted financial assets while hindering tangible asset returns. Looking forward, fiscal and monetary support to households and businesses may finally spur inflation in commodities and real assets. Therefore, we continue to believe a well-diversified portfolio should include a thoughtful allocation to tangible assets.

Outlook Summary

The global economy is poised to achieve strong year-over-year growth and only modest inflationary pressures in the first half of 2021, which should benefit risk assets and support spread sectors. However, the path toward social and economic normalization will probably be jagged and uneven until vaccine distribution efforts harmonize a more balanced global recovery experience.

As 2020 came to a close, the prospects for a broader economic reopening foreshadowed the benefits of portfolio diversification. Economic sectors and equity styles that lagged earlier in the recovery, such as small cap, value and international stocks, produced substantial returns in the last two months of the calendar year.

While it is uncertain if the market rotation that began in November will continue, our baseline forecast anticipates continuing (if uneven) reparations in the global economy – a backdrop best addressed via fully diversified investment programs that otherwise align with your investment goals and objectives.

For more information and assistance, please contact any professional at Cedar Cove Wealth Partners.

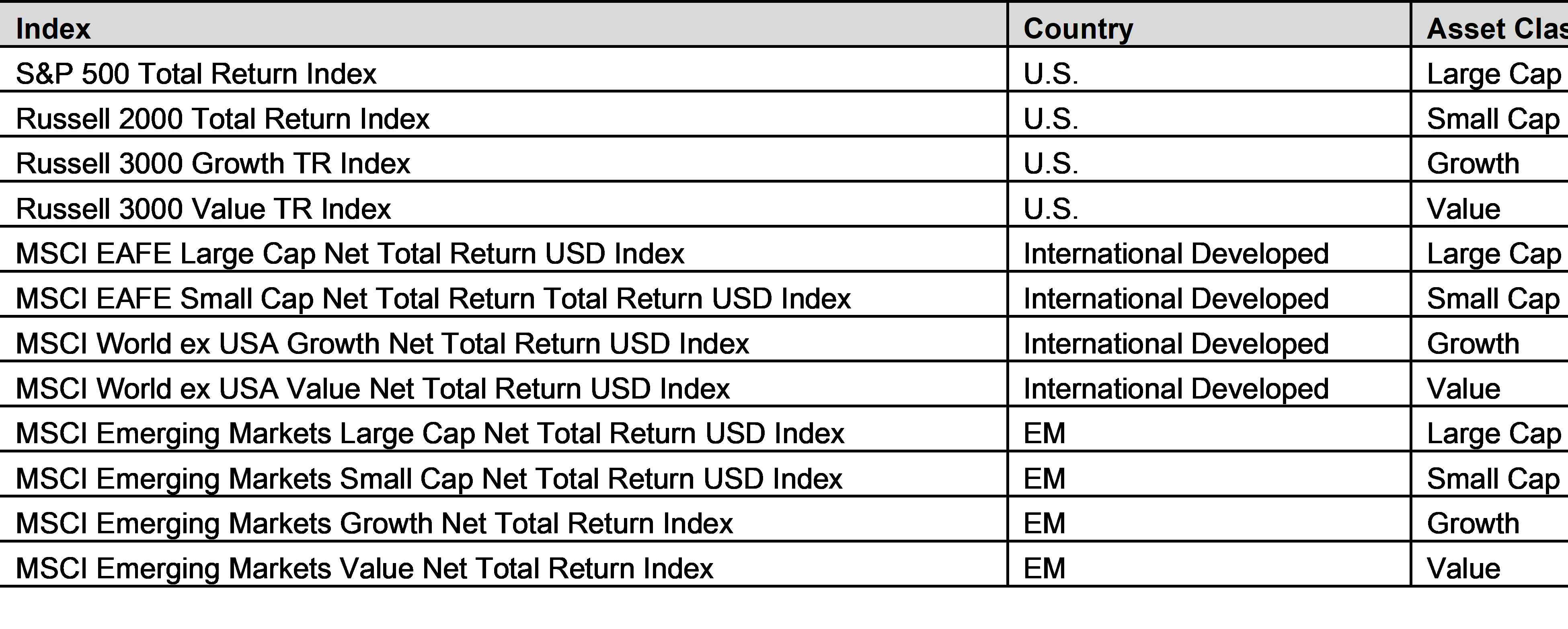

Disclosures and Index Proxies

This report does not represent a specific investment recommendation. Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and are reported gross of any fees and expenses. Any forecasts represent future expectations and actual returns; volatilities and correlations will differ from forecasts. When referencing asset class returns or statistics, the following indices are used to represent those asset classes, unless otherwise notes. Each index is unmanaged and investors can not actually invest directly into an index:

Footnotes

- DiMeo Schneider & Associates, L.L.C.

- DiMeo Schneider & Associates, L.L.C.

- DiMeo Schneider & Associates, L.L.C.

- DiMeo Schneider & Associates, L.L.C.

- DiMeo Schneider & Associates, L.L.C.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

THRIVENT IS THE MARKETING NAME FOR THRIVENT FINANCIAL FOR LUTHERANS. Certain insurance and annuity products issued by Thrivent. Not available in all states.

Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent. Clients will separately engage a broker-dealer or custodian to safeguard their investment advisory assets. Review the Thrivent Advisor Network ADV Disclosure Brochure and Wrap-Fee Program Brochure for a full description of services, fees and expenses. Thrivent Advisor Network LLC advisors may also be registered representatives of a broker-dealer to offer securities products.