Economic recovery, updated vaccine and portfolio considerations

Key Observations

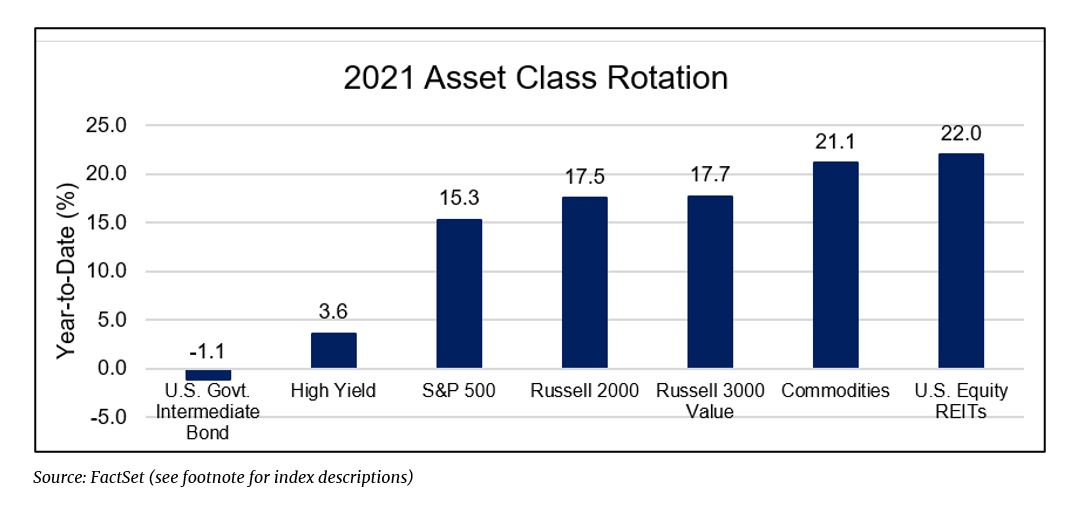

- Financial market returns year-to-date coincide closely with the premise of an expanding global economic recovery. Economic momentum and a robust earnings backdrop have fostered uniformly positive global equity returns while this same strength has been the impetus for elevated interest rates, hampering fixed income returns.

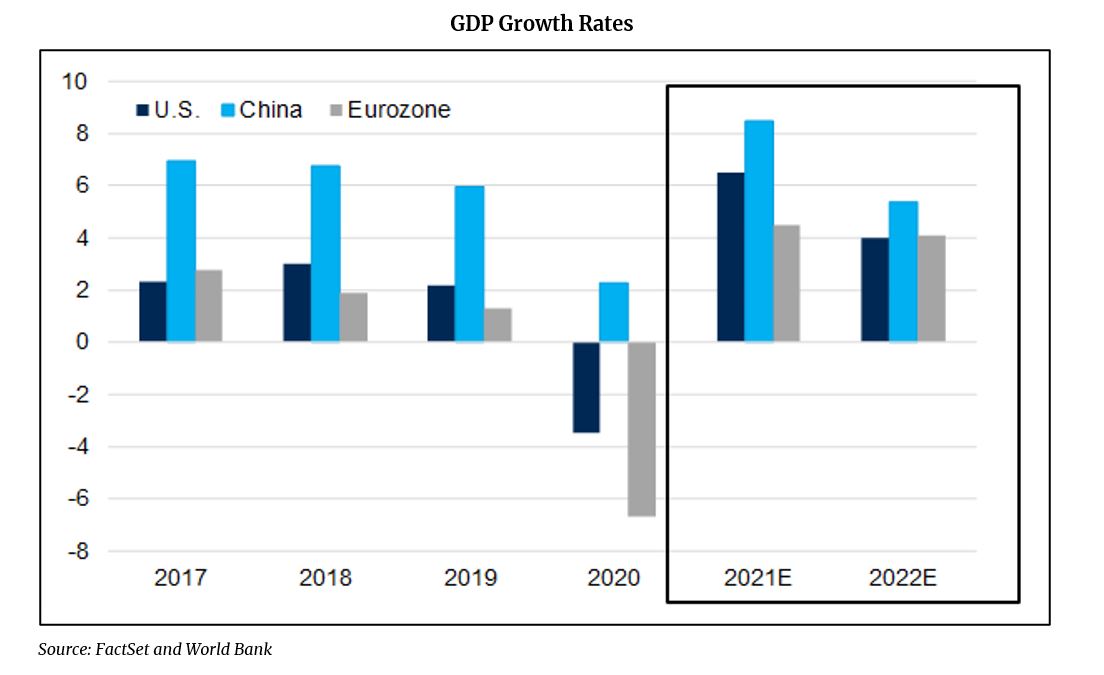

- Our baseline expectation anticipates that the continuation of the economic revival is well underway but its relative strength may be shifting overseas, particularly to the Eurozone, where amplifying vaccination efforts and the prospects for additional stimulus reign.

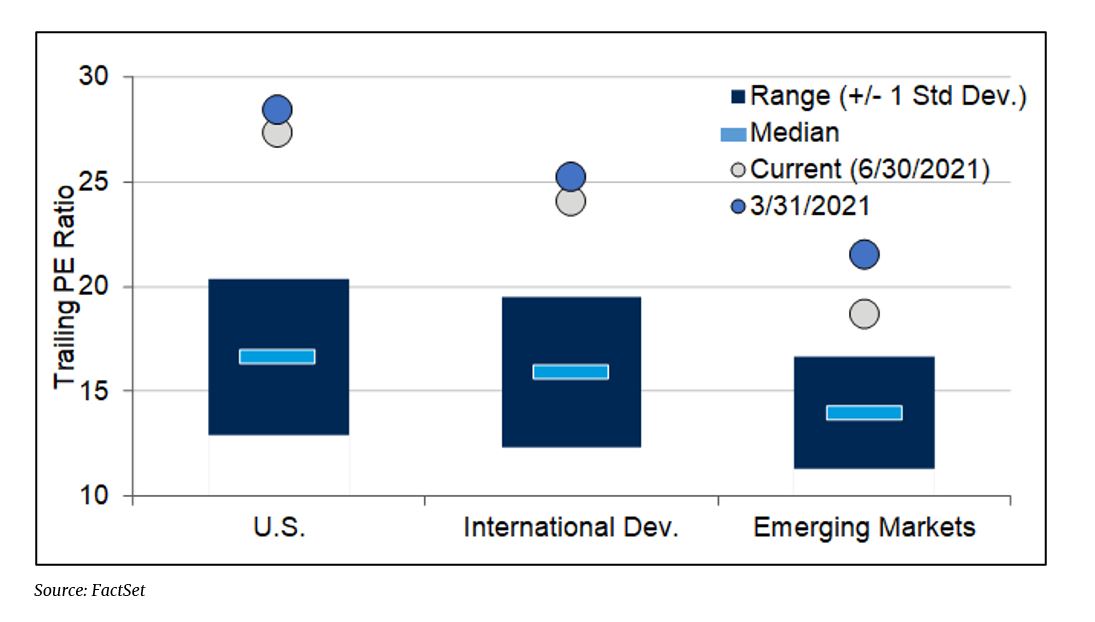

- Our case for thoughtful risk-taking remains intact. While the historically sharp and compressed pace of the recovery has spawned exceptionally strong returns across many segments of the capital markets and elevated valuations, the economic expansion should continue apace, fueled by still highly accommodative stimulus, reopening impetus and broader vaccination.

Financial Market Conditions

Economic Growth

Forecasts for global economic growth in 2021 and 2022 remain robust with the World Bank projecting a 5.6 percent growth rate for 2021 and a 4.3 percent rate in 2022. If achieved, this recovery pace would be the most rapid recovery from crisis in some 80 years and provides a full reckoning of the extraordinary levels of stimulus applied to the recovery and of the herculean efforts to develop and distribute vaccines.

While the case for further global economic growth remains compelling, we are mindful that near-term base effect comparisons and a bifurcated pattern of growth may be masking some complexities of the recovery. It is anticipated that a year-end 2021 global output will still be about 2 percent below its pre-pandemic level with many countries not fully recovering output until 2023.

Monetary Policy

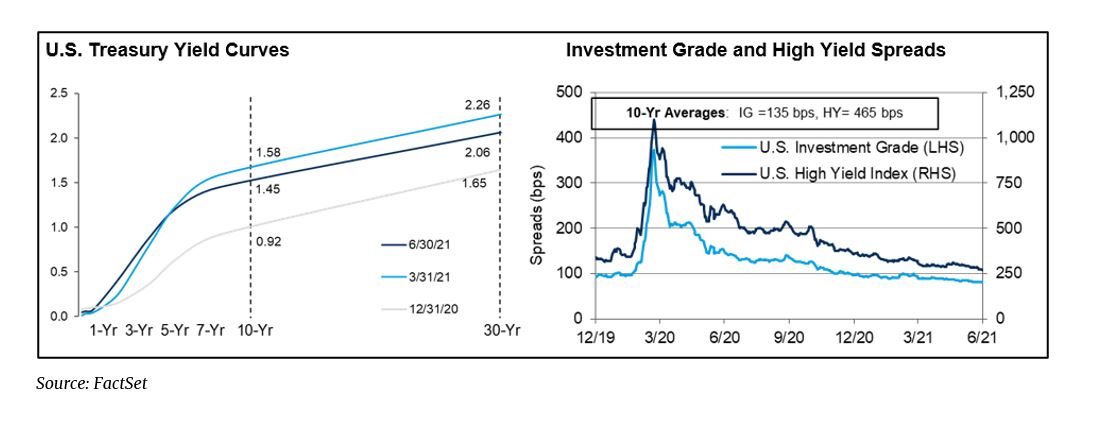

While a narrative centering on the potential for heightened inflation has taken hold among investors, the Fed left the existing (and highly accommodative) rate policy and asset purchasing program unchanged at its June meeting. Of note, 13 of the 18 governors now anticipate at least one rate hike being necessary by the end of 2023. Monetary policy elsewhere around the world, on balance, remains stimulative as authorities seek to strike a balance between fostering economic repairs and their respective policy objectives.

Fiscal Policy

Governments across the globe unleashed unprecedented amounts of fiscal stimulus in the immediate aftermath of the pandemic’s onset and measures of additional potential support persist. President Biden’s late May announcement outlining upwards of $6 trillion of supplemental spending serves as the readiest evidence of this pledge. However, we expect the global fiscal response, considered collectively, has likely peaked and that further efforts to initiate stimulus via these channels may prove to be less impactful. In our view, fiscal largesse retains the capacity to vitalize economic activity in the near-term, but investors should be alert to the possibility that the longer-term impacts of wide scale spending can serve as a headwind to economic growth.

Inflation

Perhaps no topic has garnered a higher level of financial press and investor attention than inflation over the last few months. A global economy under rapid repair resulted in supply chain disruptions and notably higher input prices, fueling speculation that inflation may be on an accelerated trajectory to outpace the Fed’s longstanding 2 percent target. However, more recent moderations in, for example, raw material prices suggest some of these pressures are beginning to alleviate as organizations undertake the steps necessary to recalibrate their operations. We accept the Fed’s premise that inflation is likely to run at a meaningfully elevated level in the near term before ultimately settling at a higher than pre-pandemic level, but at a rate that should not threaten the global recovery.

Currency

The Fed’s recent more hawkish tone, while very preliminary and measured, has resulted in a bout of U.S. dollar strength despite the greenback’s somewhat lofty valuation and the geographically broadening economic recovery on display. Otherwise, the dollar was trending weaker for much of the second quarter. Absent a material flight to quality/risk-off market event, we expect the dollar to be range-bound, taking its directional cues from developments on the global economic front and the policy responses devised by authorities to mitigate, what are certain to be, differentiated paths to recovery.

Investment Themes for 2021 – Mid-Year Updates

We began the year with the general adage that investors would be compensated for bearing thoughtful measures of risk and this stance has, by and large, proven to be a rewarding posture for investors. In our view, prudent risk-taking will continue to be beneficial to investors in the second half of the year. The still potent forces of stimulus and steady gains on the vaccination front continue to nurture reopening plans worldwide but not yet quite to a level suggestive of anything other than that the global economy recovery resides squarely mid-cycle. Capital market returns can still be robust at this stage of the cycle and investors should position themselves accordingly.

- The Pandemic’s Wake

Mid-Year Observation & Portfolio Impact

At the beginning of the year, we held firm to the notion that an improving global economy, drawing momentum from both stimulus and escalating vaccine distribution, could provide the foundation for a broader pattern of asset class returns. As evidenced in the graph below, this pattern has largely come to pass with small capitalization and value stocks (and other asset classes more directly linked to an economic reawakening) providing return advantages year-to-date over the “stay-at-home” stocks that led the performance rolls as markets regained their footing in the spring of 2020.

Despite the recent improvement, the path the economy will take to full recovery remains uncertain. As such, it is premature to suggest that markets are poised to sustain this discernible shift in rotation, in our view. In the interim, broad diversification across and within asset classes remains the most effective tool by which investors can steer through this uncertainty.

- Opportunities in a Low Interest Rate Environment

Mid-Year Observation & Portfolio Impact

We began the year with the baseline recognition that very low interest rates would render fixed income investing challenging in the near-term. This expectation has come to pass as evidenced by the negative returns experienced across the broad fixed income markets year-to-date. While interest rates more recently have settled a touch lower, they elevated meaningfully earlier in the year as economic momentum crystallized. However, yields available across the entirety of the maturity spectrum continue to hover near historic lows and, once again, center our expectations toward modest near-term bond returns. Moreover, the incremental yields (“spreads” in market parlance) available across many non-treasury securities remain at compressed levels.

We expect investing conditions in the fixed income arena to remain challenged in the second half of the year. Dynamic bond strategies continue to resonate with us as an effective means by which to respond to these challenges. As we suggested at the beginning of the year, investing with a nimble mindset and an enhanced appreciation of selectively will again remain important guideposts for fixed income investing in the coming months.

- A Case for Global Equity Exposure

Mid-Year Observation & Portfolio Impact

International equities have demonstrated pockets of strength year-to-date (May being the most recent example) and we reiterate our stance that they have an important and rightful role to play when constructing a portfolio. Their more modest valuations offer a measure of protection from more elevated domestic equity valuations and, as we indicated at the beginning of the year, their inherent composition leverages more directly to an economic backdrop demonstrating material improvement, particularly within the Eurozone where stimulus efforts are robust and re-openings are accelerating.

A range-bound U.S. dollar and a stabilizing commodity complex may lend additional measures of support to foreign equities through the balance of the year.

- Returns from Real Assets

Mid-Year Observation & Portfolio Impact

At the beginning of the year, we outlined that subdued inflation metrics had been the recurring norm for quite some time as the effects of globalization, improved productivity and U.S. dollar strength conspired to keep price levels in check and below the stated Fed target rate of 2 percent. At the same time, we championed the idea that the dynamics around inflation and the factors that influence it were in transition and could nudge inflation higher. Specifically, we suggested that the consolidated effect of monetary and fiscal policy meaningfully elevated the possibility of higher inflation and that has, indeed, transpired year-to-date. Commodity and tangible asset performance have responded in kind, validating our beginning of the year view that an allocation to a diversified stream of real assets had a role in a thoughtful portfolio construction exercise. Current considerations on the inflation front prevail in favor of a dedicated real asset allocation for the balance of the year, in our view.

Outlook Summary

Investing conditions remain, in our opinion, advantageous as we enter the second half of the year, yet we are mindful that the very sharp recoveries of the economy and many markets will require heightened investor vigilance. We expect to encounter periodic bouts of increased market volatility through the remainder of the year. However, a global economic recovery that is not yet complete, the beneficial influences of still highly accommodative stimulus, and the steady pace of reopenings worldwide, when synchronized, inform our general view that investing will prove to be a constructive effort through the balance of the year and our case for thoughtful risk asset exposure is unchanged.

For more information, please contact any of the professionals at Cedar Cove Wealth Partners.

Footnotes

2021 Asset Class Rotation Index Descriptions:

- US Govt Intermediate Bond: BBgBarc US Govt Interm TR USD

- High Yield: BBgBarc US Corporate High Yield TR USD

- S&P 500 TR USD

- Russell 2000 TR USD

- Russell 3000 Value TR USD

- Commodities: Bloomberg Commodity TR USD

- S. Equity REITS FTSE Nareit Equity REITs TR USD

Advisory Persons of Thrivent provide advisory services under a practice name or “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

THRIVENT IS THE MARKETING NAME FOR THRIVENT FINANIAL FOR LUTHERANS. Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent.