Our expertise is in providing financial advice and asset management solutions, which is why our comments on recent events are focused there, but this should not be taken to understate the humanitarian fallout. We hope for a peaceful and swift resolution.

Russia commenced a full-scale invasion on its Western neighbor, Ukraine. The situation remains very fluid, but likely came more quickly than expected, leaving Ukraine and its allies underprepared for the conflict that has now become a war.

Why is Russia invading Ukraine?

The official line states Russia is invading to protect Russian citizens, especially those in the self-proclaimed Russian republics of Donetsk and Luhansk who declared such independence in 2014 when Russia last invalided Ukraine. However, Russian interests go much deeper. The collapse of the Soviet Union in 1991 left Russia vastly depleted from its former days of empire building. Security analysts believe this “one people, single whole” mentality is the true root.

What is happening in Ukraine?

On February 23, 2022, Russia launched a series of coordinated attacks on key military targets across the Ukraine including air, ground and amphibious assaults. The situation remains fluid.

How have markets reacted?

As expected, risk assets have retreated on the unfortunate news. Equities broadly, even those with modest or very little connection to any exposure in the region, have sold off in sympathy. Gold, treasuries, and other risk-off havens have gained in value. Commodity markets have also reacted with Oil prices moving over $100 a barrel. European natural gas contracts moved up as much as 31% based on the news given Russia is a major supplier to Europe for the natural resource. As of close yesterday, Russian equites were down over 22% YTD. It is likely they will see continued pressure in the short-term as the US and EU allies weigh additional sanctions and actions. Globally, currency markets are reacting as well. The Russian Ruble fells as much as 9% relative to the U.S. dollar and Ukraine suspended its currency operations under martial law(1).

How does this impact our portfolios?

Most acutely, Russia is 3.21% of the Emerging Markets Index(2), which we have a modest overweight to compared to the ACWI(3). It is important to remember the Emerging Market Index is a collection of countries with different economic and geographical realities. While the Russian invasion is most likely to hurt the country itself and their immediate neighbors, other countries may benefit. For example, Brazil has benefited from higher oil prices globally and if tensions keep prices up, it may continue to do so in the future. Brazil is 4.61% of the index today and is up 20% YTD(4). Additionally, companies outside of Russia may experience more nuanced impacts. For example, French car manufacturer Renault has a subsidiary in Russia and fell nearly 10% on the news. On the global fixed income side, Russia accounts for 0.25% of the global bond benchmark and therefore is modest contributor to overall risk of the index(5).

What is the impact on our managers?

Our active managers, especially those with allocations or personnel in the region are well aware of the current environment. While decisions will vary from manager to manager, our core EM equity manager has a modest underweight to the county relative to the index (~1.15% relative to 3% benchmark weight). Within global fixed income our core manager has a modest overweight (~1.61% vs 0.25%)(6).

Clearly the situation is fluid, and these opinions may change. However, even if current allocations to the country prove detrimental, we believe these highly capable and skilled investors add value throughout and over a cycle. Not simply on getting one “call” right or wrong.

Does this impact the Fed?

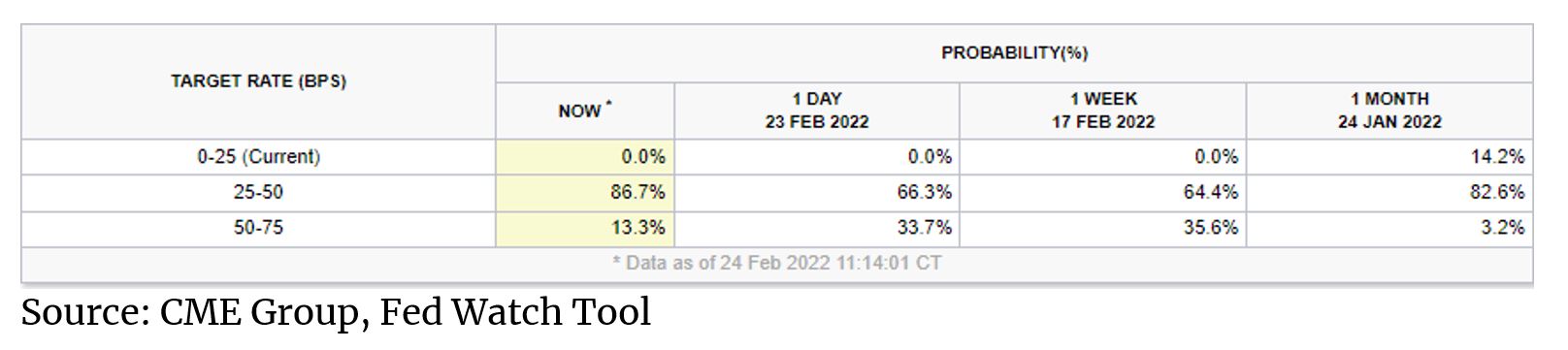

Central banks globally, including the Fed are in a difficult position. With interest to keep prices under control while not smothering economic growth, they are walking a fine line. Markets largely expect a 25bps increase from the Fed after its March 15/16 meeting. However, conversation has been drifting to a 50bps increase given recent headline inflation numbers. The invasion has a dual effect of adding fuel to the fire of inflation with higher energy prices but may provide the Fed cover to move at the more modest pace of 25bps based on greater uncertainty. A 25bps increase is presumed to be the preferred path for the Fed. Futures prices that indicate the market’s “best guess” on what the Fed will do also reflect this change in sentiment as shown below.

How does this change our outlook?

At this time, it does not. While this is a very unfortunate humanitarian event, at this point it has limited global significance to broader themes built into our portfolios or our forward-looking capital market assumptions. As a reminder, we entered the year with a risk-off view believing in more volatile markets and as such positioned portfolios accordingly. (Please see our recent blog post for more details.) While we had no prognostication of war in Crimea, it is nonetheless consistent with our views and allocations. Additionally, our outlook moves beyond the immediate and seeks to allocate efficiently over the next 10 years. While a material headline event today, we believe the impact over the next 10 years is likely to be limited. Should the facts of this statement change, so will our opinion and we will update all with the practical implications. it is nonetheless consistent with our views and allocations. Additionally, our outlook moves beyond the immediate and seeks to allocate efficiently over the next 10 years. While a material headline event today, we believe the impact over the next 10 years is likely to be limited. Should the facts of this statement change, so will our opinion and we will update all with the practical implications.

What is the historical context?

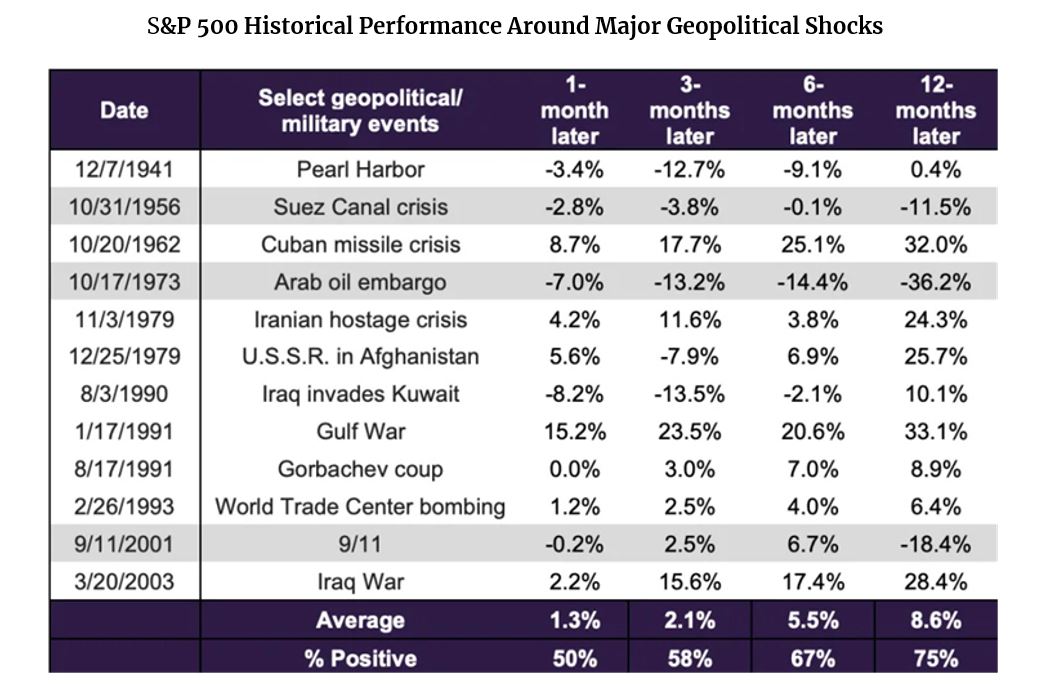

An analysis from Truist Advisory Services shows that the S&P 500 has, historically speaking, recovered in a matter of months following a geopolitical shock, so long as the event itself didn’t lead to or coincide with a recession.

“The Russia-Ukraine border crisis complicates the near-term market outlook,” wrote Keith Lerner, co-chief investment officer at Truist Advisory Services. “That said, history suggests these types of events, which can be devastating from a humanitarian standpoint, tend to have a fleeting market impact unless they lead to a recession. Our work suggests recession risk in the U.S. remains low. Rising geopolitical risks, alongside the upcoming Fed transition, argue for continued choppier waters in the markets near term.”

Are there any additional resources to review?

While the situation remains incredibly fluid, we found the following articles helpful.

- Reuters: As markets churn over Russia-Ukraine conflict, history shows fleeting impact

- Barron’s: How Oil Could Hit $150. It’s Not Just About Russia

As always, should you have additional questions, please reach out to any of the professionals at Cedar Cove Wealth Partners.

Footnotes

- WSJ, Bloomberg, Fiducient Advisors as of intra-day trading 2/24/2022

- Morningstar Direct, 1/31/2022, MSCI EM Index NR USD

- Morningstar Direct, 1/31/2022 MSCI ACWI EM Index NR USD weight 8.14%, Russia weight 0.37%

- Morningstar Direct, 1/31/2022, MSCI Brazil Index NR USD, 19.57% YTD through 2/23/2022

- Bloomberg Global Aggregate TR USD Index; Fiducient Advisors

- Morningstar Direct, JPMorgan Emerging Markets Equity I as of 12/31/2021, PGIM Global Total Return as of 1/31/2022

Disclosures and Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- MSCI Emerging Markets Index captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- MSCI Brazil Index is designed to measure the performance of the large and mid-cap segments of the Brazilian market. With 50 constituents, the index covers about 85% of the Brazilian equity universe.

- Bloomberg Global Aggregate Bond Index The Index measures the performance of the global investment grade, fixed-rate bond markets. The benchmark includes government, government-related and corporate bonds, as well as asset-backed, mortgage-backed and commercial mortgage-backed securities from both developed and emerging markets issuers.

Advisory Persons of Thrivent provide advisory services under a practice name or “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

THRIVENT IS THE MARKETING NAME FOR THRIVENT FINANIAL FOR LUTHERANS. Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent.