Shifting Sentiment at Summer Summit

Inflation improvement and weaker economic data shift Fed sentiment.

August 2024

Market Recap

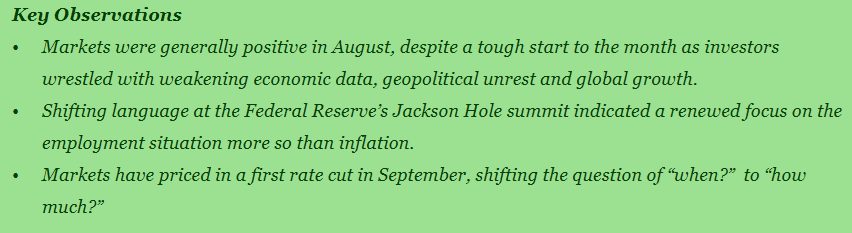

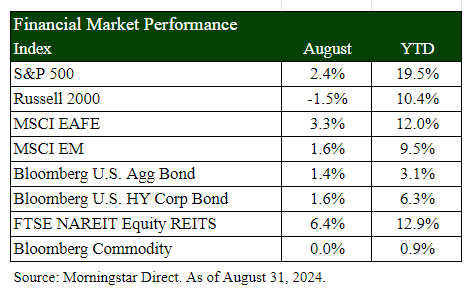

July’s volatility carried into early August as investors navigated the unwind of the Japanese yen carry trade, geopolitical unrest in the Middle East and growing concerns about economic growth following weak ISM and labor market reports. Equity markets initially declined in the first week, with U.S. small caps hit hardest. However, a favorable earnings season and shifting sentiment at the Federal Reserve’s Jackson Hole summit boosted markets later in the month. Most equity markets ultimately finished higher, led by international developed stocks (MSCI EAFE Index), which benefited from a weakening U.S. dollar. The S&P 500 Index (U.S. large cap) also ended the month up, supported by a strong earnings season. With 99% of companies reporting, Q2 blended year-over-year earnings growth for the S&P 500 reached 11.3%, the highest measure since 2021.[1] Small-cap stocks (Russell 2000 Index) rebounded but remained just below positive territory for the month.

Interest rates moved lower during the month on improving inflation as U.S. CPI fell below 3% for the first time since March 2021.[2] This was a boon for fixed income and other related assets as both high-quality and below-investment-grade sectors of the fixed income market delivered positive returns. REITs were the standout in August, crossing into double-digit return territory on a year-to-date basis. Most components of the REIT index posted gains, with the self-storage sub-sector as a notable contributor. Commodity markets were mixed, resulting in a flat overall return. Metals performed well and were driven by strong demand and a weakening U.S. dollar, while energy prices declined amid uncertainty about global economic growth. Additionally, OPEC’s plans to ease production cuts later this year could create further headwinds for oil prices.

Shifting Focus Signals Cuts

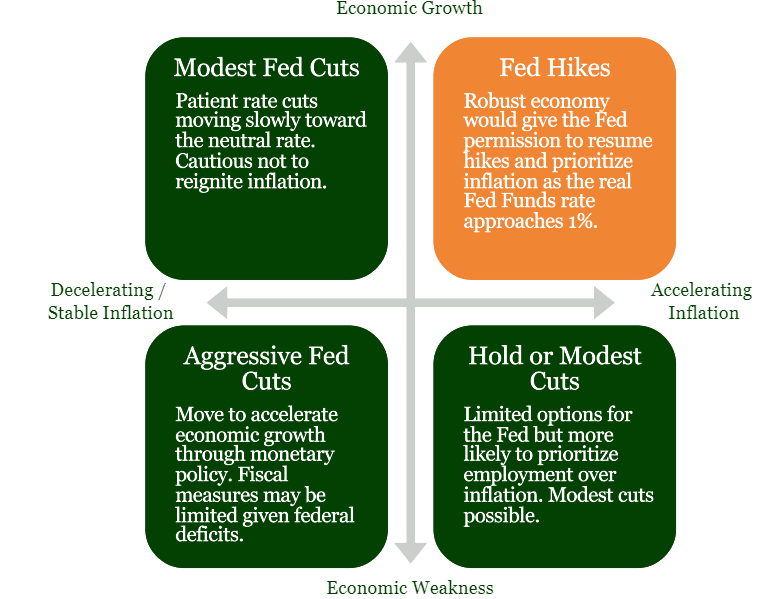

Sentiment shifted at the Federal Reserve’s annual Jackson Hole summit following weaker economic data, including signs of a cooling labor market with unemployment rising to 4.2% and significant downward revisions to previous non-farm payrolls [2] . Inflation continues to progress toward the Fed’s 2% target, and Fed Chair Jerome Powell reflected this shift in his recent speech: “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”[3] Markets now anticipate the Fed’s first rate cut will occur at the September 2024 FOMC meeting, shifting the question from “when?” to “how much?” Whether the initial cut is 25 or 50 basis points, we believe the ultimate direction of interest rates is downward, with multiple paths leading there. The Fed has indicated a willingness to support the labor market if needed. While all scenarios are possible, we believe the most probable outcomes are either cuts based on moderating inflation and economic resilience or more aggressive cuts in response to economic weakness.

Outlook

As summer fades and we approach the fall, we expect greater clarity from the Fed on upcoming policy actions, creating a potential tailwind for fixed income assets with several paths for rate cuts. While inflation is improving, recent economic data has been trending downward. We remain mindful that the upcoming election, global geopolitical tensions and unforeseen events may continue to keep market volatility elevated. Thoughtful asset allocation and constructing diversified portfolios to enhance resilience are increasingly important as we prepare for the markets ahead.

End Notes

[1] FactSet Earnings Insight as of September 6, 2024.

[2] FactSet. BLS. As of September 6, 2024.

[3] Federal Reserve Chair Jerome Powell, August 23, 2024. https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm

Disclosures & Definitions

Investment advisory services offered through Thrivent Advisor Network, LLC., (herein referred to as “TAN”), a registered investment adviser. Clients will separately engage an unaffiliated broker-dealer or custodian to safeguard their investment advisory assets. Review the Thrivent Advisor Network Financial Planning and Consulting Services, Investment Management Services (Non-Wrap) and Wrap-Fee Program brochures (Form ADV Part 2A and 2A Appendix 1 brochures) for a full description of services, fees and expenses, available at Thriventadvisornetwork.com. Thrivent Advisor Network, LLC financial advisors may also be registered representatives of a broker-dealer to offer securities products.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities, or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

This material is provided for informational purposes only and is not solely intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Advisory services offered through Thrivent Advisor Network, LLC.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

Advisory Persons of Thrivent Advisor Network provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Cedar Cove Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies. Information in this message is for the intended recipient[s] only. Please visit our website www.cedarcovewealth.com for important disclosures.

Thrivent Investment Management Inc. is a registered investment adviser, member FINRA and SIPC, and a subsidiary of Thrivent, the marketing name for Thrivent Financial for Lutherans. Thrivent.com/disclosures.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

- The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Material Risks

- Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

- Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

- Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

- International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impact by currency and/or country specific risks which may result in lower liquidity in some markets.

- Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

- Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrow.

The Bureau of Labor Statistics (BLS) is an agency of the United States Department of Labor. It is the principal fact-finding agency in the broad field of labor economics and statistics and serves as part of the U.S. Federal Statistical System. BLS collects, calculates, analyzes, and publishes data essential to the public, employers, researchers, and government organizations.

The term Institute for Supply Management (ISM) refers to a nonprofit supply management association. Established in 1915, it is the largest organization of its kind. It provides certification, development, education, and research for individuals and corporations in the supply management and purchasing professions.

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent, intergovernmental Organization, created at the Baghdad Conference on September 10–14, 1960, by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela. OPEC’s objective is to co-ordinate and unify petroleum policies among Member Countries, in order to secure fair and stable prices for petroleum producers; an efficient, economic and regular supply of petroleum to consuming nations; and a fair return on capital to those investing in the industry.

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate.