The 2024 U.S. Election: Where to From Here?

11/13/2024

Summary

• In the early hours of Wednesday, November 6, with 277 of the 270 electoral college votes needed, Trump was declared the winner of the 2024 U.S. Presidential Election. The Republican party has also gained control of the Senate.

• A Republican sweep of Congress would make it much easier for Trump to push through his agenda; however, it may take several more days to determine which party has secured control of the House.

• Diversification should include healthy exposures to risk while minimizing exposure to longer-term bonds. We still like profitable small caps.

• This market note provides further insights on the economy and the potential market response.

Overview

On Wednesday, November 6, with 277 of the 270 electoral college votes needed, Trump was declared the winner of the 2024 U.S. Presidential Election. Trump will be sworn in at the inauguration on Monday, January 20, 2025, and the new members of Congress will assemble on January 3, 2025. The Republican party has also gained control of the Senate, and, while the house remains undecided, the stage is set for a Republican sweep.

Trump won majority in each of the seven swing states, with the race in Pennsylvania—anticipated to be the key determinant of the presidential winner—being called in the early hours of Wednesday morning. Exit polls show that, for the first time in at least twenty years, self-identified independents accounted for a larger share of voters (at 34%) than Democrats (at 32%) and tied with Republicans (at 34%).1 Trump is also the first Republican president to win the popular vote (at 51%) in twenty years.

Final second-quarter gross domestic product (GDP) estimates indicated that annualized quarter-over-quarter growth rose from 1.6% in the first quarter to 3.0% in the second quarter.1 Compared to the first quarter, the acceleration in GDP was primarily driven by increased government spending (rising from 1.8% of GDP to 3.1% in the second quarter) and consumer spending (from 1.9% to 2.8%).1

Market Implications

Below are our views on the potential policy response and market implications of a Trump win.

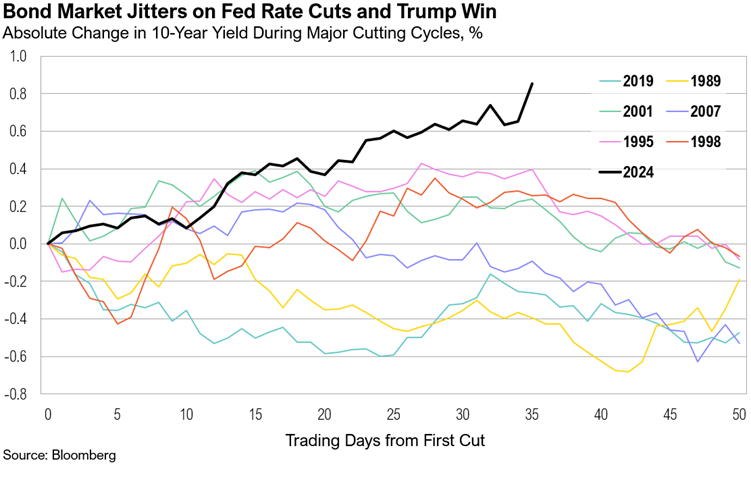

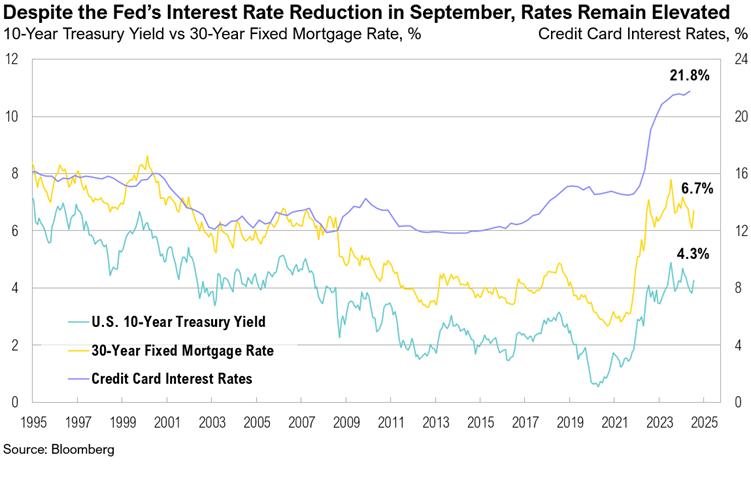

- Monetary policy implications: Trump’s proposed policies—tax cuts, global tariffs, and border control—are likely to be inflationary in the near term. However, there are potential offsets, such as the proposed deportation of undocumented immigrants, which could alleviate housing pressure. On balance, we believe that Trump’s policies would support nominal growth but also lead to higher long-term inflation expectations and bond yields. The Federal Reserve’s response may be harder to call given its recent tolerance for higher inflation. Trump has stated that he would not reappoint Powell but would allow him to complete his term, which runs until May 2026. The market currently anticipates the equivalent of one additional 25-basis-point rate cut before year-end, which we believe is on track, as the Fed aims to maintain a non-political stance. However, the likelihood of rate cuts in 2025 has now come into question, with markets now anticipating the equivalent of around 0.7% in reductions next year, compared to nearly 1.0% two weeks ago.2 Any increase in inflation between now and year-end could be managed through forward guidance, potentially moderating rate cut expectations for 2025.

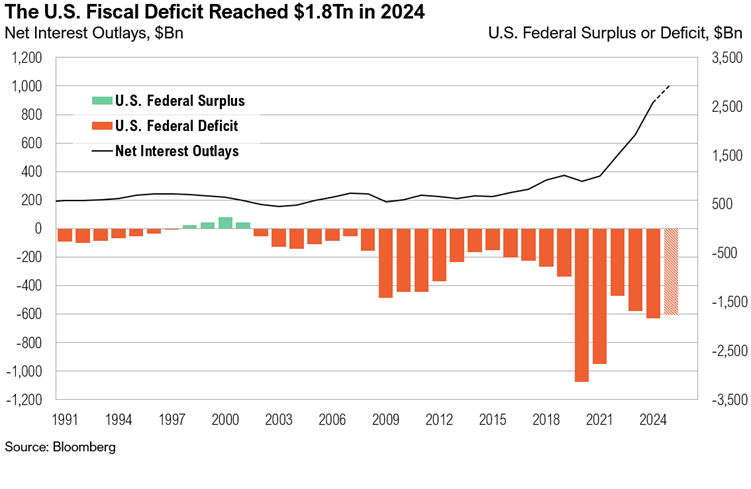

- Fiscal policy implications: The consensus is that a Trump victory will negatively impact the deficit, primarily due to the estimated $4 trillion cost of extending the Tax Cuts and Jobs Act (TCJA), with any offset from higher tariffs remaining uncertain.

- Can the bull market continue? There is no reason it cannot continue, as long as the policy backdrop contributing to it remains in place and the bond market tolerates the excesses (i.e., yields do not rise too much). Historically, markets tend to rally following elections, as uncertainty subsides. While a split Congress has historically been the most favorable outcome for the stock market, a Republican sweep is the next best outcome. Years featuring a split Congress (since 1951) averaged gains of 14.5%, compared to 11% under a Republican Congress and 6.7% under a Democratic Congress.3

- What does the result mean for bond yields? As long as the current policy mix focuses on near-term growth priorities at the expense of addressing the U.S. fiscal deficit, we remain cautious. Even in the event of an economic slowdown, we believe policymakers would view any meaningful decline in yields as further justification to continue with stimulative monetary and fiscal policies, which would ultimately be detrimental for bonds. We would, however, consider extending duration if the 10-year Treasury yield approaches 5%, but any adjustments will be modest and incremental.

Opportunities

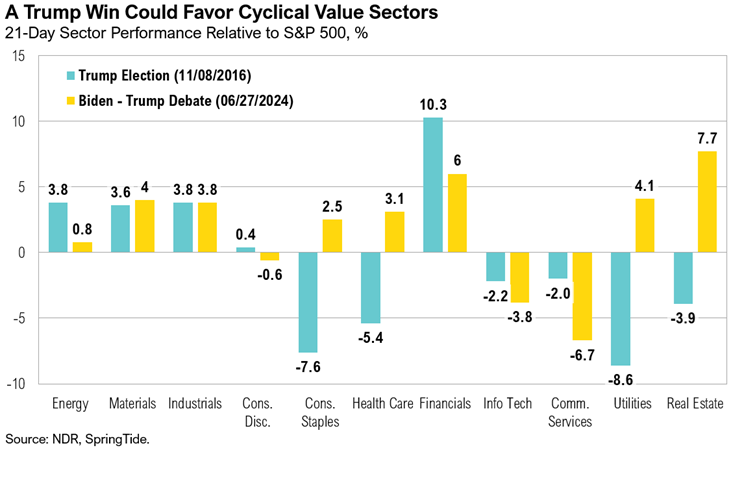

Opportunities stemming from a Trump presidency would include profitable small caps, energy, and digital assets.

- “Drill, baby, drill”: We believe that energy and fossil fuel stocks could perform well under a Trump administration, as observed following the 2016 election. We also anticipate that Trump’s focus on fossil fuels would lead to increased drilling activity and potentially lower energy prices, all else equal.4 For example, crude oil prices fell by more than 9% during the October Trump surge (from 10/4 to 10/29). This could benefit oil services companies, which are currently out of favor, and have favorable fundamentals (oil services are currently trading at a 9.2% forward free cash flow yield). Additionally, energy has historically been the top-performing sector following elections, on average, since 1972. We remain constructive on nuclear energy. Lower energy prices also support consumer spending.

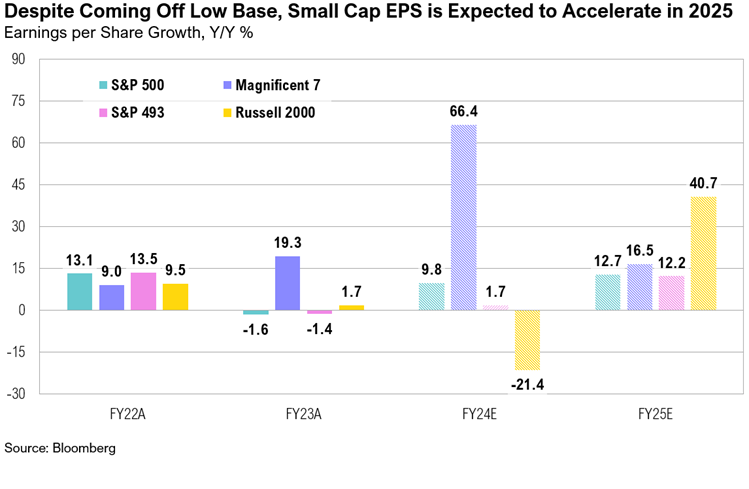

- Rotation to small caps: The potential for increased onshoring and reduced regulation could benefit small caps. Additionally, small-cap earnings growth is projected to accelerate, even as earnings growth for the broader market slows. If market estimates are directionally accurate, this shift in growth rates could favor small-cap stocks. Historically, small caps also tend to outperform large caps following elections, with average gains of 17% in the year after elections compared to U.S. large-cap stocks, which gain an average of 12%.

- Other sectors & industries: Additional areas that we believe could benefit include financials and defense stocks. With Republicans controlling the White House and Senate, support for higher defense spending is likely to grow, though control of the House could affect some priorities and specific budget levels. We expect funding for Israel and Taiwan to continue without interruption, but aid for Ukraine may face challenges. Overall, increasing defense funding remains the path of least resistance in Washington. Financials should continue to benefit from a steeper yield curve and more supportive M&A and consolidation backdrop.

- Digital assets: Trump and Vance have been unambiguously supportive of digital assets including bitcoin and we view the result as good news for the space. The suggestion of a strategic bitcoin reserve could drive further gains should it materialize.

Risks

- Trade and Tariffs reignite inflation: While some of this may be a negotiating tactic, it is likely that Trump would impose additional tariffs, particularly on China, which could have inflationary effects. Estimates suggest tariffs could range from 10-20% on most foreign goods and potentially reach as high as 60% on imports from China.5,6

- K-shaped divergences continue: A significant risk that was present under both administrations was the increasing polarization of wealth distribution in the U.S. The “average” consumer appears to be disappearing, with wealthier households benefiting from asset inflation, while lower-income consumers are squeezed by rising living costs without the advantages of asset ownership. This trend is likely to continue.

- Green energy deemphasized: The preference for fossil fuels will come at the expense of further subsidies and policy support for green energy investments. We would expect the Trump administration to remove restrictions on drilling on federal land and to withdraw from the Paris climate accord.

- Deficits and the bond vigilantes: Between potentially higher nominal growth, lower taxes and continued loose fiscal policy, bond yields could continue to see upwards pressure. While the U.S. deficit is clearly unsustainable, and recent moves in bond yields suggest concern, it is less clear when the rise in yields will start to be viewed negatively by equities. This is key risk we will be monitoring.

Summary

Opportunities stemming from a Trump presidency include profitable small caps, energy, and digital assets, among others. Risks are focused on the growing budget deficit and a potential resurgence of inflation. If the so called “bond vigilantes” are provoked too much, pressures could build on policymakers to rein in loose monetary and fiscal policy. At some point, higher yields could negatively affect stock prices. On balance, we want to echo the guidance we shared leading up to the election: diversification should include healthy exposures to risk while minimizing exposure to longer-term bonds.

Disclosures & Definitions

Advisory Persons of Thrivent Advisor Network provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Cedar Cove Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies.

Securities offered through Thrivent Investment Management Inc. (“TIMI”), member FINRA and SIPC, and a subsidiary of Thrivent, the marketing name for Thrivent Financial for Lutherans. Thrivent.com/disclosures. TIMI and Cedar Cove Wealth Partners are not affiliated companies.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested and cannot invest directly in an index. Opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable. A summary description of the principal risks of investing in a particular model is available upon request. There can be no assurance that a model will achieve its investment objectives. Investment strategies employed by the advisor in selecting investments for the model portfolio may not result in an increase in the value of your investment or in overall performance equal to other investments. The model portfolio’s investment objectives may be changed at any time without prior notice. Portfolio allocations are based on a model portfolio, which may not be suitable for all investors. Clients should also consider the transactions costs and/or tax consequences that might result from rebalancing a model portfolio. Frequent rebalancing may incur additional costs and/or tax consequences versus less rebalancing. Please notify us if there have been any changes to your financial situation or your investment objectives, or if you would like to place or modify any reasonable restrictions on the management of your account.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

Index Benchmarks presented within this report may not reflect factors relevant for your portfolio or your unique risks, goals or investment objectives. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index.

The Russell 2000® Index measures the performance of the 2,000 smaller companies that are included in the Russell 3000® Index, which itself is made up of nearly all U.S. stocks. The Russell 2000® is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market.

The S&P 493 is an equal-weighted index of the S&P 500 that includes the 493 stocks that are not part of the Magnificent Seven. The S&P 493 can be a good option for investors looking to diversify away from the Magnificent Seven, which are a group of mega-capitalization tech stocks that have accounted for much of the market’s gains in the first half of the year.

The S&P 500® Index, or the Standard & Poor’s 500® Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

The Chicago Mercantile Exchange (CME) Group Inc. is a financial services company. Headquartered in Chicago, the company operates financial derivatives exchanges including the Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, and The Commodity Exchange. The company also owns 27% of S&P Dow Jones Indices.

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock.

A fiscal year (FY) is a 12-month or 52- or 53-week period that an organization uses for accounting, budgeting, and planning purposes. Fiscal years are often different from the calendar year and can start and end on different dates depending on the organization’s financial needs. Adding an “A” means actual, adding a “B” means budgeted, and adding an “E” means expected. Examples: FY22A, FY23A, FY24E, FY25E

M&A stands for mergers and acquisitions, which is a term used to describe the process of combining companies or their assets:

- Merger: When two companies of similar size combine to form a new entity

- Acquisition: When one company buys another, typically a smaller company by a larger one

The Magnificent 7 stocks are a group of mega-cap stocks that drive the market’s performance due to their heavy weighting in major stock indexes such as the Standard & Poor’s 500 and the Nasdaq 100. The group’s seven stocks earned their name in 2023 due to their strong performance and ability to power indexes higher seemingly without help from smaller stocks. The Magnificent 7 includes the following: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG and GOOGL), Amazon (AMZN), NVIDIA (NVDA), Tesla (TSLA), and Meta Platforms (META).

Ned Davis Research Group (NDR) is an independent investment research firm with over 1,100 institutional clients in over three dozen countries. It was founded in 1980.

The Tax Cuts and Jobs Act (“TCJA”) of 2017 changed deductions, depreciation, expensing, tax credits and other tax items that affect businesses.

YOY or Y/Y stands for “year-over-year” and is a term used to compare data from a specific period of time to the same period in the previous year. This method is used to analyze and assess the growth or decline of a variable over a 12-month period.

Citations

- Reuters: https://www.reuters.com/world/us/first-us-independent-turnout-tops-democrats-ties-republicans-edison-research-2024-11-06/

- CME FedWatch: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- Business Insider: https://markets.businessinsider.com/news/stocks/stock-market-impact-president-election-congressional-makeup-democrats-republicans-party-2020-7-1029374181

- Texas Tribune: https://www.texastribune.org/2024/08/15/donald-trump-energy-policy-fact-check-election-2024/

- CNN: https://edition.cnn.com/2024/10/13/politics/donald-trump-tariffs/index.html

- Reuters: https://www.reuters.com/markets/trumps-tariffs-would-reorder-trade-flows-raise-costs-draw-retaliation-2024-11-04/

- Reuters: https://www.reuters.com/business/energy/how-do-trump-harris-differ-energy-policy-2024-10-29/

- BBC: https://www.bbc.com/news/articles/c0lp48ldgyeo