Market Commentary

Vibes

Q4, 2024

Summary

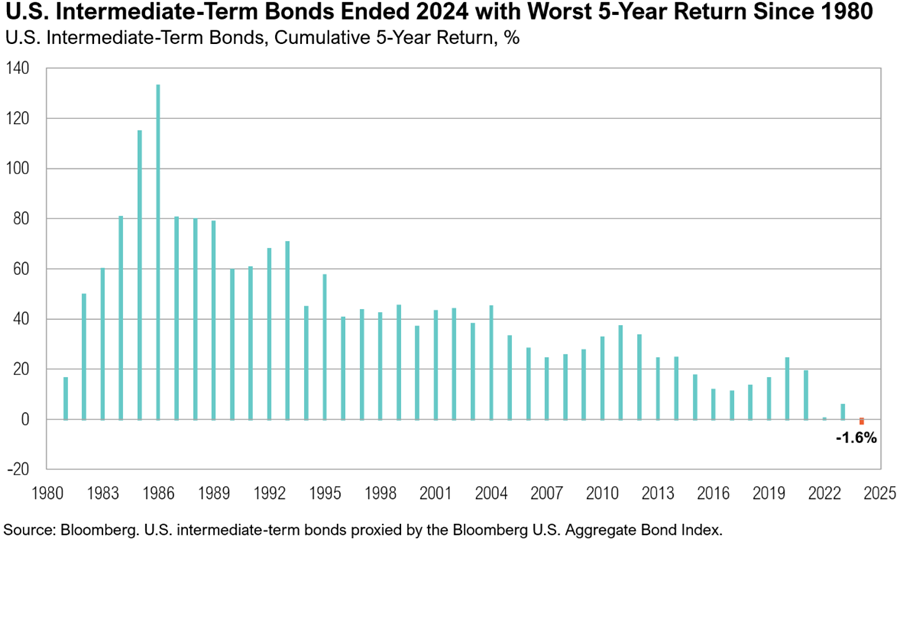

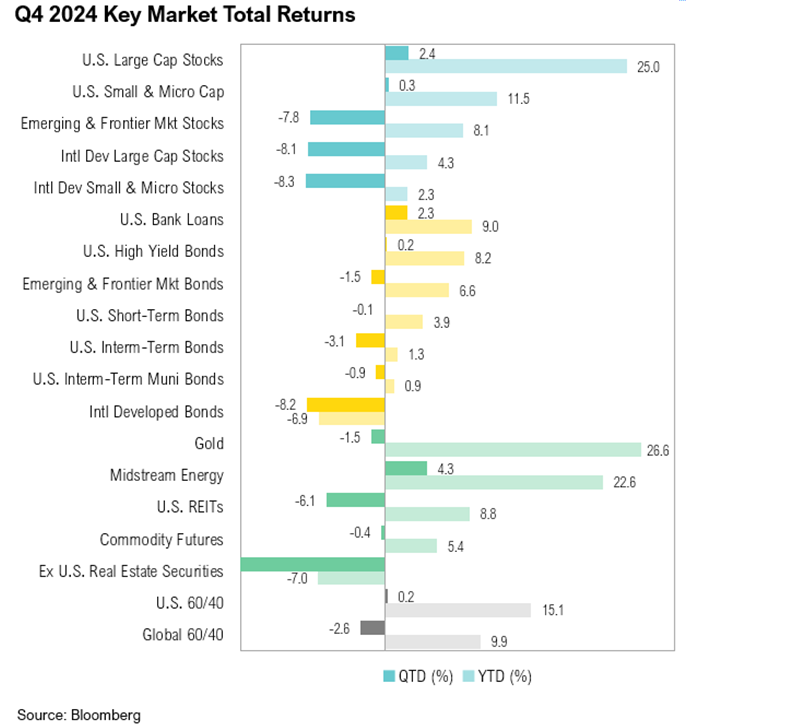

• U.S. large-cap stocks hit over 50 new all-time highs in 2024, ending the year up 25%. U.S. small-cap stocks gained 11%, and U.S. intermediate-term bonds ended 2024 up 1%.

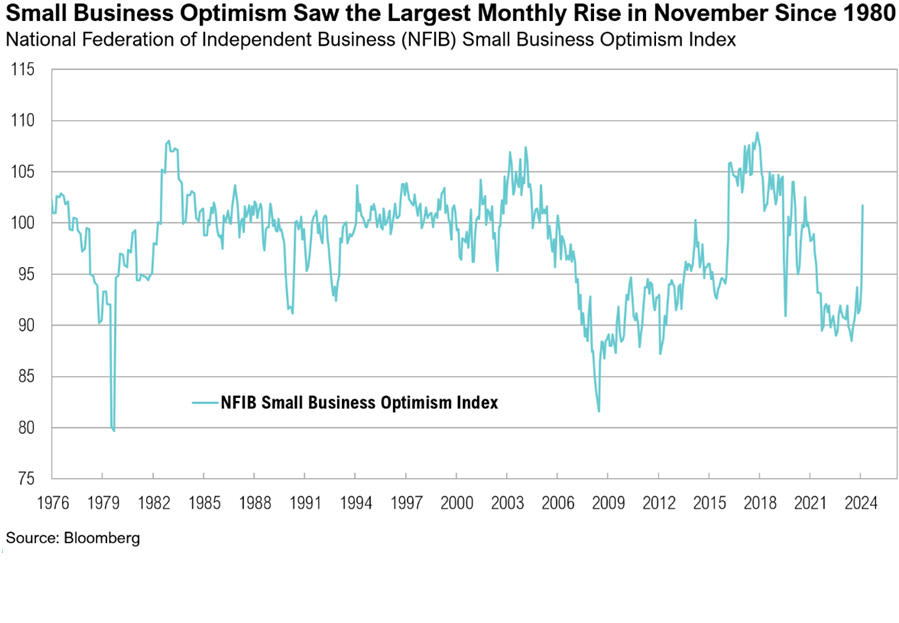

• Post-election, small business optimism recorded the largest month-over-month increase since July 1980. A similar shift in sentiment was noted in various CFO surveys.

• Despite sticky inflation and higher interest rates, the U.S. consumer remained resilient while U.S. government spending continued unchecked.

• The incoming administration appears focused on the challenging task of bolstering economic growth while at the same time reducing the deficit.

• The most critical element of this endeavor will be curtailing the deficit while keeping longer-term yields contained so as not to disrupt economic expansion.

Overview

Markets ended 2024 with mixed results. U.S. large-cap stocks ended the fourth quarter up 2.4% and ended the year up 25.0%. The S&P 500 hit over 50 new all-time highs in 2024. Over the past two years, the S&P 500 has risen a cumulative 53%—the strongest performance since the nearly 66% increase experienced between 1997 and 1998. U.S. small-cap stocks gained 11.5% over the year after a fourth quarter gain of 0.3%. In contrast, 2024 was another challenging year for U.S. intermediate term bonds. After declining 3.1% in the fourth quarter, the Bloomberg U.S. Aggregate Bond Index ended 2024 up only 1.3%. This marks a cumulative decline of 1.6% over the past five years, making it the worst five-year return since at least 1980.

After easing to 2.4% year over year in September, headline inflation, as measured by the Consumer Price Index (CPI), ended the year at 2.7%, and housing inflation remained the key contributor.1 Core inflation, which excludes food and energy, ended 2024 up 3.3% and has been above 3% for 43 months.2 On September 18, with inflation still well above the official 2% target, the Federal Reserve (Fed) began to cut short-term interest rates. During the fourth quarter and across three different meetings, the Fed cut interest rates by 1.0%, bringing the year-end rate to 4.25% – 4.50%.

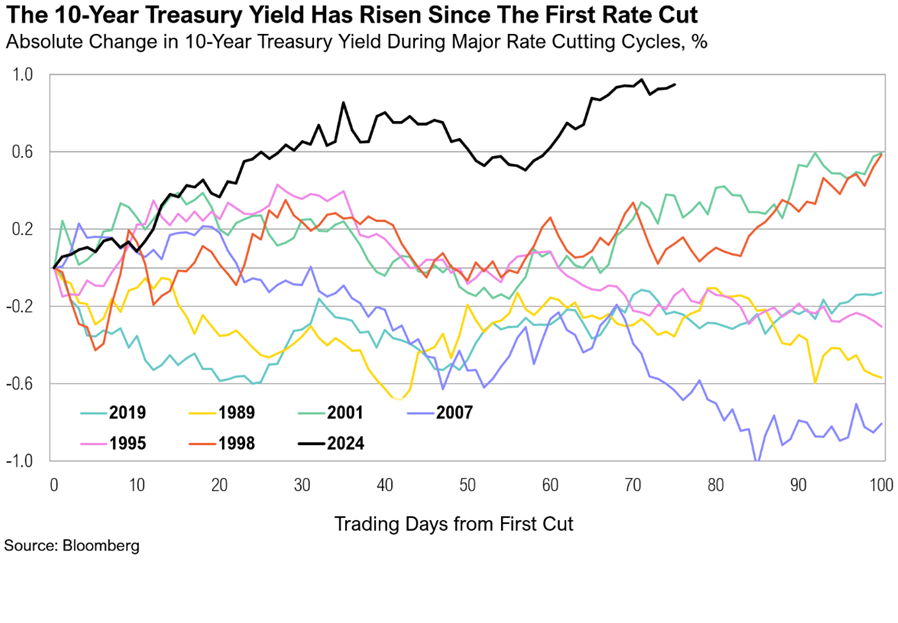

At the December 18 Federal Open Market Committee meeting, the Fed’s economic projections indicated that committee members expected the equivalent of two 0.25% rate cuts in 2025, even though their year-end 2025 inflation expectations increased from 2.1% to 2.5%.3 The 10-year Treasury yield has climbed higher since the first rate cut in September (an unprecedented move relative to historical rate-cutting cycles). This pushed 30-year mortgage rates higher, to end December at 7.3%, 0.6% higher than they were prior to the first Fed interest rate cut. By early January, markets were anticipating the equivalent of only one 0.25% interest rate reduction for 2025.4

Two key factors have characterized the U.S. economy: the resilience of the U.S. consumer and the alarming rate of government deficit spending. Consumer spending continues to be robust. Online sales increased by a record $241 billion (or 9% year over year) over the holiday spending period.5 This is despite credit card interest rates nearing record highs at an average of 24% and the personal saving rate standing at 4.4%—well below the historical average of 8.4%. According to Mastercard Economics Chief Economist Michelle Meyer:

“The holiday shopping season revealed a consumer who is willing and able to spend but driven by a search for value as can be seen by concentrated e-commerce spending during the biggest promotional periods… Solid spending during this holiday season underscores the strength we observed from the consumer all year, supported by the healthy labor market and household wealth gains.”6

In the 2024 fiscal year, the U.S. government fiscal deficit reached $1.8 trillion, making it the largest deficit in a non-crisis or non-recessionary year on record.7 Already, the fiscal deficit for 2025 (which began in October) has surpassed $620 billion and is projected to reach $1.9 trillion by the fiscal year end.8,9 With interest rates still elevated, the interest expense on U.S. public debt rose by 20% over the past 12 months, climbing to $886 billion. This is nearly on par with national defense spending ($928 billion) and spending on health care programs ($926 billion).

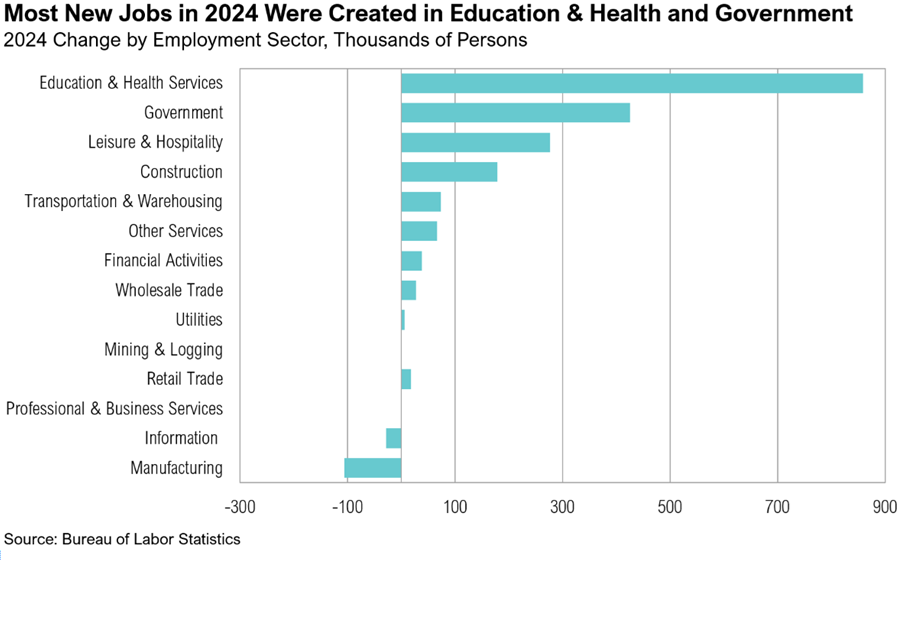

The U.S. economy expanded by an annualized 3.1% quarter over quarter in the third quarter, and projections for the fourth quarter are estimated to be 2.3%. The services sector remains the primary growth driver. The ISM Services PMI continued to expand throughout the fourth quarter and ended December with a reading of 54.1.10 In contrast, the manufacturing sector has contracted for eight consecutive months, and the ISM Manufacturing PMI ended 2024 with an improved reading of 49.3—the highest reading since April. (A reading below 50 signals contraction in the sector).11 The manufacturing sector experienced the largest reduction in employment in 2024, losing over 106,000 jobs during the year, followed by the information sector, which lost over 28,000 jobs. Conversely, the education and health services sectors added nearly 860,000 jobs in 2024, and the government sector gained nearly 425,000 jobs.12 Overall, the labor market remained robust throughout 2024, and the unemployment rate finished the year near record lows at 4.1%.13

Vibes

One of the defining events of 2024 was the 60th U.S. presidential election, held on November 5. After the election, which saw the Republican party emerge as the decisive winner, consumer sentiment ticked up from 72 in November to 74 in December. This was largely driven by the 16-point spike in Republican sentiment, which offset the nearly 12-point drop in Democrat sentiment. Similarly, small business optimism jumped by eight points in November—the largest month-over-month increase since July 1980.14 A similar (7.4 points) spike in small business optimism was recorded in 2016. After that, the Russell 2000 Index gained 25% over the next 12 months and an annualized 13% over the next four years. The S&P 500 gained 24% over the next 12 months and an annualized 20% over the next four years.

According to the November 2024 National Federation of Independent Business (NFIB) small business survey, 36% of respondents expect the economy to improve, 18% of respondents plan to increase hiring, and 28% plan to make capital outlays.14 CFO surveys of larger companies conducted between October and November 2024 show a similar increase in optimism about the U.S. economy, and concerns about the health of the economy, company sales, and revenue declined sharply relative to the survey conducted between August and September 2024.15 Another area of markets that continued to signal economic optimism were U.S. high yield credit spreads, which ended December near historical lows, at 2.7%, and continue to suggest that the economy may achieve a “soft landing.” Further, the November Job Openings and Labor Turnover Survey (JOLTS) report, released in early January, showed signs of stability. Job openings ticked higher for the second consecutive month (the first two-month rising streak since December 2022), and the total number of job openings surpassed the 8-million mark for the first time since May 2024.16 Vibes are shifting with larger businesses too as they seek to align themselves with the new administration. Meta recently announced changes to the company’s moderation policies and practices, citing a shifting political and social landscape and a commitment to embracing free speech.17,18 The company has also announced that it will be moving its content moderation and trust and safety teams from California to Texas.17,18

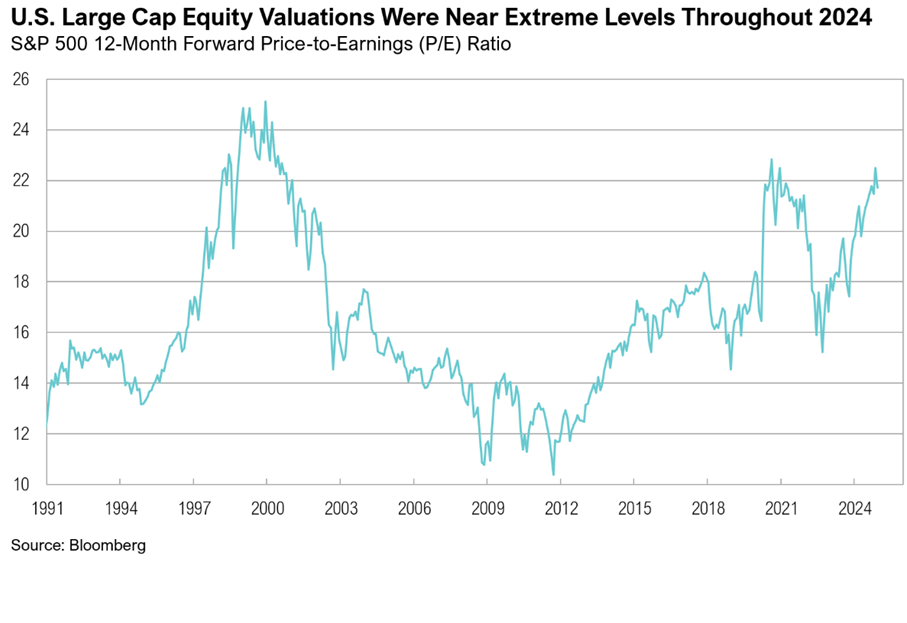

Even before post-election economic sentiment surveys showed increased optimism, equity valuations remained elevated throughout the year and even climbed back to extreme levels, akin to the tech bubble. Despite valuations at extremes, U.S. large-cap returns were once again above average. With only 19% of S&P 500 constituents outperforming the broader index over the past year, returns remain substantially driven by a handful of mega-cap technology stocks, including Nvidia (up 171% in 2024), Meta (up 65%), Tesla (up 63%), and Amazon (up 44%). The Magnificent Seven now account for over a third of the S&P 500, up from a fifth of the index in 2022. Earnings growth for the S&P 500 is expected to be 15% for 2025.19 In contrast, earnings growth for the Russell 2000 index is expected to accelerate by 40% in 2025.20

With the new administration taking office on January 20, President-Elect Donald Trump has already announced several key nominations for Cabinet posts and White House roles. Among these is Scott Bessent (a former Democrat donor), who has been nominated as Treasury Secretary.21,22 Bessent has outlined a “3-3-3” target, which includes achieving 3% economic growth, reducing the federal deficit to 3% of GDP by 2028, and increasing daily energy production by the equivalent of 3 million barrels of oil—approximately a 20% increase from current levels.23,24,25 When asked about his decision to accept the nomination, Bessent remarked:

“This election cycle is the last chance for the U.S. to grow our way out of this mountain of debt…”26

Bessent’s remark shows a stark contrast between the incoming and outgoing administrations’ perspectives on the U.S. fiscal deficit burden and a shift in attitude about approaching the issue. At a Wall Street Journal CEO Summit, held on December 10, current Treasury Secretary Janet Yellen remarked:

“Well, I am concerned about fiscal sustainability, and I am sorry that we haven’t made more progress. I believe that the deficit needs to be brought down, especially now that we’re in an environment of higher interest rates.”27

Conquering the rocky mountain size of the fiscal deficit is daunting; however, there is reason for optimism. In addition to Bessent, Trump has also announced the creation of the Department of Government Efficiency (DOGE). Led by Elon Musk and Vivek Ramaswamy, the department will seek to improve government accountability and efficiency within federal agencies.28 While DOGE will not be an official government department but rather an advisory board, it could enlighten and subsequently lighten the U.S. fiscal deficit burden. For instance, the U.S. spent $20 million on a Sesame Street show in Iraq and uses less than 20% of its building space in D.C.29,30 Further, an estimated $100 billion in improper payments were made in the Medicare and Medicaid programs, and in December, the Department of Justice filed a complaint against CVS for filling unlawful prescriptions of opioids and seeking reimbursement for them.31,32

The new administration is expected to usher in a more supportive regulatory environment for digital assets. Bitcoin surged 43% in the fourth quarter and ended 2024 up 130%. In a noteworthy move, Trump has appointed David Sacks as the nation’s first Crypto and Artificial Intelligence (AI) Czar. In this advisory role, Sacks will facilitate communication between government officials and tech industry leaders while working to establish a regulatory framework that supports the growth of digital currencies.33

Markets

U.S. equity markets fared significantly better than their international counterparts over the fourth quarter. U.S. large-cap stocks gained 2.4% while international developed large-cap stocks ended the quarter down 8.1%. Similarly, while U.S. small-cap stocks ended the quarter flat after gaining only 0.3%, international developed small-cap stocks dropped 8.3% over the quarter. Emerging and frontier market stocks ended the fourth quarter down 7.8%, driven by declines in South Africa (-12.1%), India (-11.3%), and Turkey (-10.1%). Plus, the U.S. dollar ended the month at its highest level since November 2022. Fixed income markets exhibited similar dynamics: while U.S. intermediate-term bonds ended the fourth quarter down 3.1%, international developed market bonds ended the quarter down 8.2%.

Despite ending the fourth quarter down 1.5%, gold ended 2024 up 26.6%, setting over 30 new record highs. After reaching a one-year low of $65.8 per barrel on September 10, West Texas Intermediate (WTI) crude oil ended the year at $71.7 per barrel. Despite rising oil prices, U.S. national average gasoline prices reached a three-year low of $3.02 on December 12.34

In September, the People’s Bank of China unveiled a series of economic stimulus measures, including interest rate cuts, increased government spending, and relaxed property market restrictions aimed at revitalizing sluggish growth in the face of a weak real estate sector and declining consumer confidence.35 However, progress has been underwhelming, and further announcements have been delayed as authorities appear to be waiting for greater clarity on tariffs and the policies of the incoming Trump administration. On December 20, a week after the Chinese government announced its first loosening of monetary policy in 14 years, short-term Chinese sovereign bond yields fell to 0.92%—their lowest level since the Global Financial Crisis.36 The MSCI China Index ended the fourth quarter down 7.7%.

In global fixed income markets, 10-year Japanese government bond (JGB) yields ended early January at the highest level since 2011, reaching 1.18%.37 Similarly, in early January, UK 10-year Gilt yields reached the highest level since August 2008, rising to 4.76%. 30-year UK Gilt yields reached the highest level since August 1998 in early January, rising to 5.3%.

Looking Forward

The incoming administration appears focused on bolstering economic growth while at the same time reducing the deficit. The most critical element of this endeavor will be curtailing the deficit and, in the process, keeping longer-term yields contained to not disrupt the economic expansion.

While the Federal Reserve can dictate short-term interest rates through policy decisions, they have less control over longer-term rates. Since the first rate cut in September, longer-term yields have reacted with a unique vibe, moving higher than other rate cutting cycles. That’s not to say a rise in bond yields is bad, per se, but unless it is driven by higher long-term growth prospects that translate to higher corporate earnings, rather than fiscal irresponsibility or other perceived policy errors, it could negatively impact risky asset valuations. It will now be up to fiscal policymakers to thread this needle. If they can, it will allow the continuation of government policies that support economic growth, which are critical for supporting equity and credit markets.

Citations

- BLS: https://www.bls.gov/news.release/cpi.nr0.htm

- FRED: https://fred.stlouisfed.org/series/CPILFESL#0

- Federal Reserve: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20241218.pdf

- CME FedWatch: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- Adobe Analytics: https://news.adobe.com/news/2025/1/newsroom-article-text-marquee

- Mastercard: https://newsroom.mastercard.com/news/press/2024/december/mastercard-spendingpulse-total-u-s-retail-sales-grew-3-8-this-holiday-season-online-remained-choice-for-consumers-increasing-6-7-yoy/

- Bipartisan Policy Center: https://bipartisanpolicy.org/report/deficit-tracker/

- U.S. Department of Treasury: https://www.fiscal.treasury.gov/files/reports-statements/mts/mts1124.pdf

- Congressional Budget Office: https://www.cbo.gov/system/files/2024-06/60039-By-the-Numbers.pdf

- ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/december/

- ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/december/

- BLS: https://www.bls.gov/news.release/empsit.nr0.htm

- BLS: https://www.bls.gov/news.release/empsit.t17.htm

- NFIB: https://www.nfib.com/wp-content/uploads/2024/12/SBET-November-2024.pdf

- Federal Reserve Bank of Richmond: https://www.richmondfed.org/research/national_economy/cfo_survey/data_and_results/2024/20241204_data_and_results

- BLS: https://www.bls.gov/jlt/

- NBC News: https://www.nbcnews.com/tech/social-media/meta-ends-fact-checking-program-community-notes-x-rcna186468

- AP News: https://apnews.com/article/meta-facts-trump-musk-community-notes-413b8495939a058ff2d25fd23f2e0f43

- FactSet: https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_010325.pdf

- Franklin Templeton: https://www.franklintempleton.lu/articles/2024/royce-investment-partners/the-prospects-for-extended-us-small-cap-outperformance

- NY Times: https://www.nytimes.com/2024/11/23/us/politics/scott-bessent-treasury-profile.html

- Wall Street Journal: https://www.wsj.com/politics/elections/the-ex-soros-executive-who-is-trumps-new-obsession-4be2d493

- CNBC: https://www.cnbc.com/2024/11/25/scott-bessent-what-trumps-treasury-pick-could-mean-for-markets.html

- Wall Street Journal: https://www.wsj.com/politics/policy/scott-bessent-sees-a-coming-global-economic-reordering-he-wants-to-be-part-of-it-533d6e71

- EIA: https://www.eia.gov/dnav/pet/hist/leafhandler.ashx?n=pet&s=mcrfpus2&f=m

- AP News: https://apnews.com/article/treasury-trump-biden-finance-elections-bessent-transition-8df8be88e4c83df4b9f3c4238966e79d

- The Hill: https://thehill.com/business/budget/5035194-yellen-budget-deficit-biden-administration/

- CNN: https://edition.cnn.com/2024/11/12/politics/elon-musk-vivek-ramaswamy-department-of-government-efficiency-trump/index.html

- Committee on Homeland Security & Government Affairs: https://www.hsgac.senate.gov/wp-content/uploads/FESTIVUS-REPORT-2024.pdf

- Washington Times: https://www.washingtontimes.com/news/2024/apr/11/government-report-finds-just-12-of-federal-offices/

- Government Accountability Office: https://www.gao.gov/products/gao-24-107487

- United States Department of Justice: https://www.justice.gov/opa/pr/justice-department-files-nationwide-lawsuit-alleging-cvs-knowingly-dispensed-controlled

- Reuters: https://www.reuters.com/world/us/trump-appoints-former-paypal-coo-david-sacks-ai-crypto-czar-2024-12-06/

- AAA: https://gasprices.aaa.com/

- CNBC: https://www.cnbc.com/2024/12/11/chinas-policy-shift-signals-economic-worries-but-outsized-stimulus-is-unlikely.html

- Financial Times: https://www.ft.com/content/94c525b1-2486-47e9-a9f1-708cf1626061

- Nikkei Asia: https://asia.nikkei.com/Business/Markets/Bonds/Japan-long-term-bond-yield-hits-13-year-high-amid-pre-auction-lull

Definitions

The Bureau of Economic Analysis (BEA) is an agency of the Department of Commerce that produces economic accounts statistics that enable government and business decision-makers, researchers, and the American public to follow and understand the performance of the nation’s economy. To do this, BEA collects source data, conducts research and analysis, develops and implements estimation methodologies, and disseminates statistics to the public.

The Bureau of the Fiscal Service (BFS) is a United States Department of the Treasury agency thatmanages the federal government’s accounting, collections, payments, and public debt.

The Bureau of Labor Statistics (BLS) is an agency of the United States Department of Labor. It is the principal fact-finding agency in the broad field of labor economics and statistics and serves as part of the U.S. Federal Statistical System. BLS collects, calculates, analyzes, and publishes data essential to the public, employers, researchers, and government organizations.

Basis points are typically expressed with the abbreviations bp, bps, or bips. A basis point is a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%. In decimal form, one basis point appears as 0.0001 (0.01/100).

Capitalization (Cap) is used to describe the size of the company, by market capitalization as follows:

mega-cap: market value of $200 billion or more.

large cap: market value between $10 billion and $200 billion.

mid-cap: market value between $2 billion and $10 billion.

small cap: market value between $250 million and $2 billion.

micro-cap: market value of less than $250 million.

The CME FedWatch Tool is a tool created by the CME Group (Chicago Mercantile Exchange Group) to act as a barometer for the market’s expectation of potential changes to the fed funds target rate while assessing potential Fed movements around Federal Open Market Committee (FOMC) meetings.

The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy. The FOMC has 12 voting members, including all seven members of the Board of Governors and a rotating group of five Reserve Bank presidents. The Chair of the Board of Governors also serves as Chair of the FOMC.

FRED (Federal Reserve Economic Data) is an online database consisting of hundreds of thousands of economic data time series from scores of national, international, public, and private sources.

A gilt is a UK Government liability denominated in sterling, issued by HM Treasury and listed on the London Stock Exchange. The term “gilt” or “gilt-edged security” is a reference to the primary characteristic of gilts as an investment: their security. Gilts are a type of loan that the UK Government borrows from investors and promises to repay, with interest. Gilts can be traded, and their value can change.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

The Magnificent 7 stocks are a group of mega-cap stocks that drive the market’s performance due to their heavy weighting in major stock indexes such as the Standard & Poor’s 500 and the Nasdaq 100. The group’s seven stocks earned their name in 2023 due to their strong performance and ability to power indexes higher seemingly without help from smaller stocks. The Magnificent 7 includes the following: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG and GOOGL), Amazon (AMZN), NVIDIA (NVDA), Tesla (TSLA), and Meta Platforms (META).

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

Performance Disclosures

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

Asset Class Definitions

Asset class performance was measured using the following benchmarks: U.S. Large Cap Stocks: S&P 500 TR Index; U.S. Small & Micro Cap: Russell 2000 TR Index; Intl Dev Large Cap Stocks: MSCI EAFE GR Index; Emerging & Frontier Market Stocks: MSCI Emerging Markets GR Index; U.S. Interm-Term Muni Bonds: Bloomberg Barclays 1-10 (1-12 Yr) Muni Bond TR Index; U.S. Interm-Term Bonds: Bloomberg Barclays U.S. Aggregate Bond TR Index; U.S. High Yield Bonds: Bloomberg Barclays U.S. Corporate High Yield TR Index; U.S. Bank Loans: S&P/LSTA U.S. Leveraged Loan Index; Intl Developed Bonds: Bloomberg Barclays Global Aggregate ex-U.S. Index; Emerging & Frontier Market Bonds: JPMorgan EMBI Global Diversified TR Index; U.S. REITs: MSCI U.S. REIT GR Index, Ex U.S. Real Estate Securities: S&P Global Ex-U.S. Property TR Index; Commodity Futures: Bloomberg Commodity TR Index; Midstream Energy: Alerian MLP TR Index; Gold: LBMA Gold Price, U.S. 60/40: 60% S&P 500 TR Index; 40% Bloomberg Barclays U.S. Aggregate Bond TR Index; Global 60/40: 60% MSCI ACWI GR Index; 40% Bloomberg Barclays Global Aggregate Bond TR Index.

Disclosures

Advisory Person(s) may use proprietary financial planning tools, calculators and third-party tools and materials (“Third-Party Materials”) to develop your financial planning recommendations. The projections or other information generated by Third-Party Materials regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time. Thrivent Advisor Network, LLC and its advisors do not provide legal, accounting or tax advice. Consult your attorney and or tax professional regarding these situations.

The return assumptions in Third-Party Materials are not reflective of any specific product, and do not include any fees or expenses that may be incurred by investing in specific products. The actual returns of a specific product may be more or less than the returns used. It is not possible to directly invest in an index. Financial forecasts, rates of return, risk, inflation, and other assumptions may be used as the basis for illustrations. They should not be considered a guarantee of future performance or a guarantee of achieving overall financial objectives. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment. Investing involves risks, including the possible loss of principal.

Advisory Persons of Thrivent Advisor Network provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Cedar Cove Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies.

Securities offered through Thrivent Investment Management Inc. (“TIMI”), member FINRA and SIPC, and a subsidiary of Thrivent, the marketing name for Thrivent Financial for Lutherans. Thrivent.com/disclosures. TIMI and Cedar Cove Wealth Partners are not affiliated companies.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested and cannot invest directly in an index. Opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable. A summary description of the principal risks of investing in a particular model is available upon request. There can be no assurance that a model will achieve its investment objectives. Investment strategies employed by the advisor in selecting investments for the model portfolio may not result in an increase in the value of your investment or in overall performance equal to other investments. The model portfolio’s investment objectives may be changed at any time without prior notice. Portfolio allocations are based on a model portfolio, which may not be suitable for all investors. Clients should also consider the transactions costs and/or tax consequences that might result from rebalancing a model portfolio. Frequent rebalancing may incur additional costs and/or tax consequences versus less rebalancing. Please notify us if there have been any changes to your financial situation or your investment objectives, or if you would like to place or modify any reasonable restrictions on the management of your account.

Index Benchmarks presented within this report may not reflect factors relevant for your portfolio or your unique risks, goals or investment objectives. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index.

The Alerian MLP Index is the leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX).

The Bloomberg Commodity® Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Index Services Limited.

The Bloomberg Global Aggregate® Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

The Bloomberg Global Aggregate ex USD Index is a measure of investment grade debt from 24 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. Bonds issued in USD are excluded.

The Bloomberg Municipal 1-10 The Bloomberg Municipal 1-10 Year Blend 1-12 Year Index Year Blend measures the performance of short and intermediate 1-12 Year Index components of the Municipal Bond Index — an unmanaged, market value-weighted index which covers the U.S. investment grade, tax-exempt bond market.

The Bloomberg U.S. Aggregate Bond® Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the U.S. bond market.

The Bloomberg U.S. Corporate High Yield Bond® Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Institute for Supply Management (ISM) purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the state of the U.S. economy.

The JPMorgan EMBI (Emerging Market Bond Index) Global Diversified Index is an unmanaged, market-capitalization weighted, total-return index tracking the traded market for U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities.

The MSCI ACWI (Morgan Stanley Capital International All Country World Index) is a stock index designed to track broad global equity-market performance.

The MSCI (Morgan Stanley Capital International) China® Index captures large and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).

The MSCI EAFE® (Morgan Stanley Capital International Europe, Australasia, and the Far East) Index is a broad market index of stocks located within countries in Europe, Australasia, and the Middle East.

The MSCI (Morgan Stanley Capital International) Emerging Markets® Index is a selection of stocks that is designed to track the financial performance of key companies in fast-growing nations.

The MSCI (Morgan Stanley Capital International) US REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity Real Estate Investment Trusts (REITs). The index is based on the MSCI USA Investable Market Index (IMI), its parent index, which captures the large, mid and small cap segments of the USA market.

The NFIB (National Federation of Independent Business) Small Business Optimism Index measures the overall optimism and outlook of small business owners regarding the economic conditions, sales expectations, hiring plans, and capital expenditures. It provides valuable insights into the sentiment of small businesses, which are a vital component of the U.S. economy.

The Russell 2000® Index measures the performance of the 2,000 smaller companies that are included in the Russell 3000® Index, which itself is made up of nearly all U.S. stocks. The Russell 2000® is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market.

The S&P 500® Index, or the Standard & Poor’s 500® Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

The S&P (Standard & Poors) Global Ex-U.S. Property Index defines and measures the investable universe of publicly traded property companies domiciled in developed and emerging markets excluding the U.S. The companies included are engaged in real estate related activities such as property ownership, management, development, rental and investment.

The S&P/LSTA (Standard & Poors/Loan Syndications and Trading Association) Leveraged Loan Index tracks the performance of institutional leveraged loans, capturing data on loan prices, spreads and other critical metrics. The index is updated daily, providing timely insights into market movements and trends.

The West Texas Intermediate Index (WTI) is the main oil benchmark for North America as it is sourced from the United States, primarily from the Permian Basin. The oil comes mainly from Texas.