Market Commentary

AI Wars

January 2025

Summary

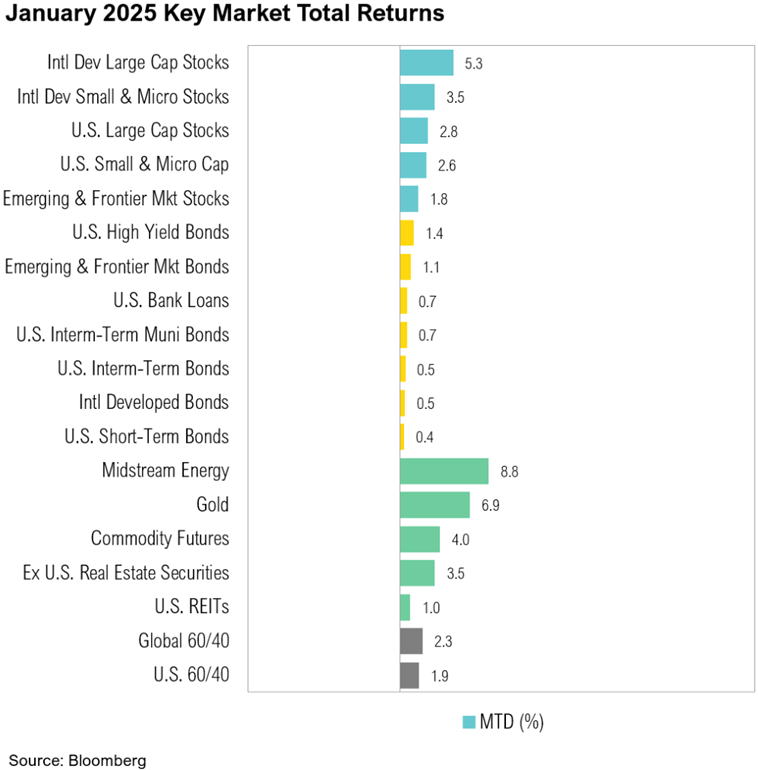

• U.S. large-cap stocks gained 2.8% in the first month of 2025 while U.S. small-cap stocks rose by 2.6%. U.S. intermediate-term bonds rose by a modest 0.5%.

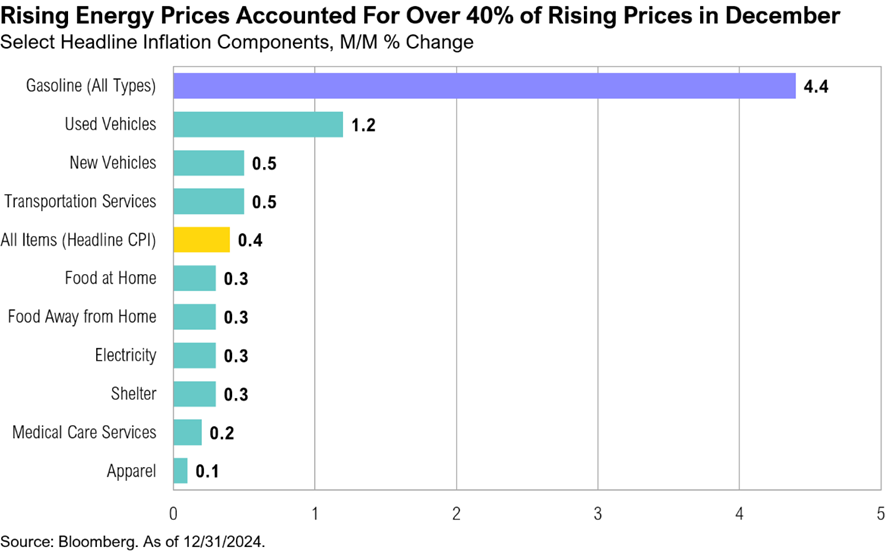

• Preliminary reports show the U.S. economy growing at a slower-than-expected pace in the fourth quarter of 2024. Headline inflation, driven by rising energy prices, rose to 2.9% in December.

• DeepSeek’s open-sourced AI model rivals OpenAI’s ChatGPT at a lower cost, potentially reshaping the AI landscape by making advanced AI more accessible.

• Trump’s return to the White House generated over 100 executive orders, including withdrawals from the WHO and Paris Agreement, major immigration changes, and the creation of the Department of Government Efficiency to address the U.S. fiscal deficit.

Overview

Markets produced compelling gains in the first month of 2025. U.S. large-cap stocks, as represented by the S&P 500 Index, ended January up 2.8% while the U.S. small-cap Russell 2000 Index gained 2.6%. U.S. intermediate-term bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, ended January up a modest 0.5%.

Preliminary estimates for the fourth-quarter GDP showed the U.S. economy growing at an annualized rate of 2.3% quarter-over-quarter, slightly below the expected 2.7%.1 This slowdown was largely due to a record-high goods trade deficit and an unexpected decline in inventories.2 Consumer spending posted its strongest quarter of the year, rising by an estimated 4.2%, while government spending increased by 2.5%.1

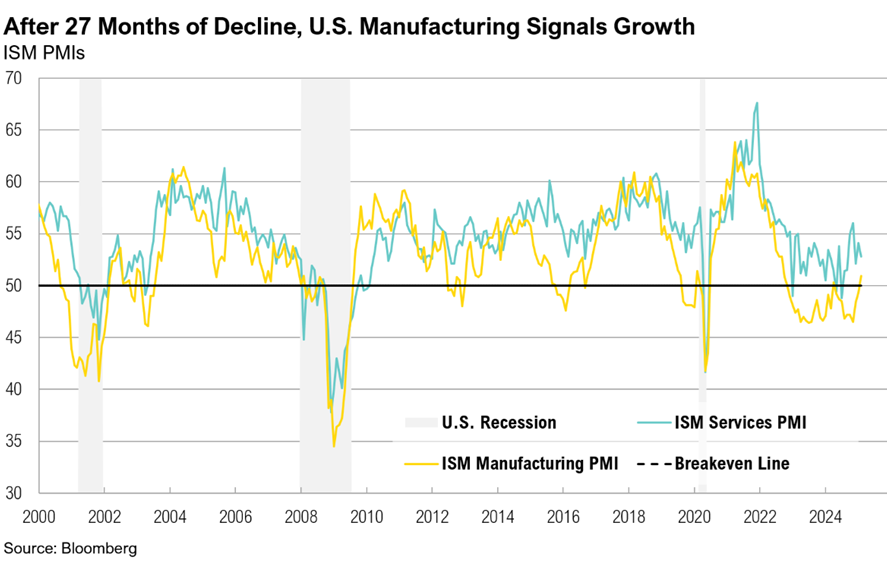

The ISM Manufacturing PMI showed manufacturing sector activity moving into expansionary territory for the first time since October 2022, registering a reading of 50.9 in January.3 The ISM Services PMI showed services sector activity continuing to grow for the seventh consecutive month, with a reading of 52.8 in January.4

After declining to 2.3% year-over-year in September 2024, headline inflation rose to 2.9% in December.5 Housing inflation continues to be the main driver of elevated inflation while energy prices have started to reaccelerate. Energy prices contributed 40% to the overall monthly increase in December, and gasoline prices increased by 4.4% in December.5

Nearly 50% of S&P 500 companies have reported their fourth-quarter earnings results. As the earnings season has progressed, growth estimates have steadily increased, rising from 11.8% at the end of December to 13.2% in the last week of January, marking the halfway point. The financials sector contributed the most to earnings growth, increasing 51%, followed by the communication services sector at 29%, and the tech sector at 16%.6 Full-year 2024 earnings growth for the S&P 500 is projected to reach 9.4%, driven largely by significant contributions from these three sectors.6 For 2025, earnings growth estimates currently stand at 14.3%, which would be the highest growth rate since 2021 when it exceeded 35%. Notably, the proportion of S&P 500 members outperforming the broader index over the past month rose to 52% at the end of January, a significant improvement from 20% at the end of December.7

AI Wars

The year did not start quietly. January not only ushered in a new administration taking office (and over 100 executive orders being carried out) but also a potential shift in the future of artificial intelligence (AI).

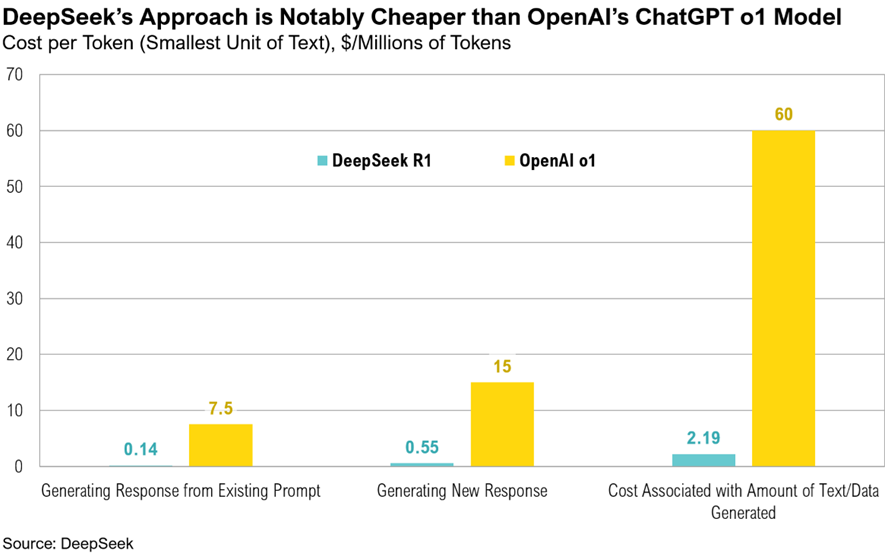

On January 20, 2025, DeepSeek—a Chinese artificial intelligence (AI) startup—launched an advanced AI model that first caught the attention of Silicon Valley, and then broader global capital markets. DeepSeek’s new model, R1, demonstrated high performance in various benchmarks, making it competitive with top U.S. AI models such as OpenAI’s ChatGPT.8,9 More importantly, the company claimed that it trained its models at a fraction of the cost of incumbent models.9,10 Venture investor Marc Andreessen called it “AI’s Sputnik moment.”11

DeepSeek’s R1 AI model introduces several advancements over traditional AI models, enhancing efficiency and maintaining accuracy. It enhances efficiency by using less memory and processing text in phrases rather than word by word, achieving faster speeds with minimal loss in accuracy.10 A distinctive feature of the R1 model is its expert system. Instead of activating all 671 billion parameters at once, it uses only 37 million targeted parameters, making it far more efficient than traditional models that activate nearly 1.8 trillion parameters continuously. Additionally, DeepSeek made its code, papers, and methods open source, allowing public access for review or replication.10

To quote Greek philosopher, Plato: “Necessity is the mother of invention.” The U.S. ban on exporting chips to China (which was first implemented in October 2022 and has grown to include bans on many essential tools needed for producing advanced semiconductors) seems to have prompted DeepSeek to achieve results more efficiently and at a lower cost.12

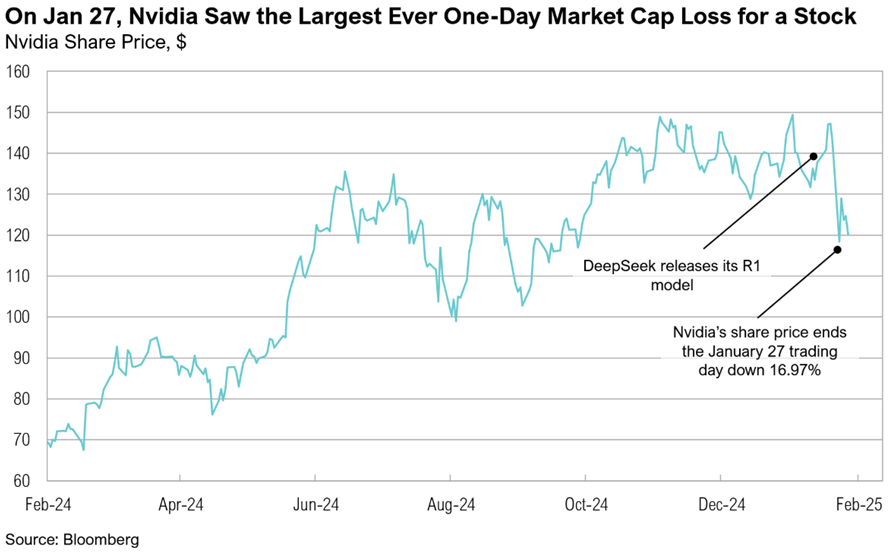

DeepSeek’s R1 model triggered a sharp sell-off in equities on Monday, January 27, one week after its release. Nvidia, whose microchips make it a key industry leader in the AI space, dropped 17%, marking the largest one-day market cap loss for a single stock in history. Nvidia ended January down 13%.

There are concerns about DeepSeek’s true development costs and privacy policy. While DeepSeek claims its setup involves only 10,000 Nvidia H100 chips, reports suggest the number may be closer to 50,000. If accurate, this would align initial training costs with those of other major AI models.8,13 Nevertheless, DeepSeek’s pricing remains about 90% lower than that of OpenAI’s ChatGPT. China’s lax data privacy regulations and internet surveillance continue to draw attention, and they have become key issues for the future of the Chinese-owned social media app, TikTok, which was briefly banned in the U.S. in January. The U.S. Navy has already banned the use of DeepSeek “in any capacity” due to “potential security and ethical concerns.”14

Concerns aside, it is not DeepSeek itself, but rather its approach, that has disrupted the status quo and thrown into question the future of U.S. tech dominance. By cutting costs and enabling large-scale AI training on consumer-grade hardware, DeepSeek has lowered the barrier to entry for AI innovation. It also suggests that powerful and cost-effective AI models are achievable without the immense infrastructure traditionally associated with major tech companies. It has also increased the likelihood that lower-cost models are not only possible but may be just as powerful and effective as industry-leading models.

For now, at least, mega-cap tech companies seem to have little interest in scaling down on AI-related spending. Both Meta and Microsoft in the last week of January announced plans to spend billions of dollars on AI.15,16 After his company announced a $65 billion spending plan on AI infrastructure expansion, Meta CEO Mark Zuckerberg said:

“I continue to think that investing very heavily in CapEx and infrastructure is going to be a strategic advantage over time. It’s possible that we’ll learn otherwise at some point, but I just think it’s way too early to call that.”15

Microsoft plans to spend $80 billion on AI in its current fiscal year. Microsoft CEO Satya Nadella noted in the company’s fourth-quarter earnings call that ongoing spending would alleviate limitations that have thus far hindered the tech giant’s ability to fully leverage AI:

“As AI becomes more efficient and accessible, we will see exponentially more demand.”16

While Meta ended January up 15%, Microsoft ended the month down 0.8%.

On January 20, coincidentally the same day that DeepSeek released its R1 model to the world, the Trump administration returned to the White House. On his first day back in office, President Trump signed over 100 executive actions, including rescinding 78 Biden-era orders, withdrawing the United States from the World Health Organization and the Paris Agreement, implementing extensive changes to U.S. immigration policy, and establishing the Department of Government Efficiency (DOGE).17

DOGE, which also commenced operations on January 20, was created to shed light on (and possibly lighten) the U.S. fiscal deficit, which is estimated to reach $1.9 trillion in 2025.18 Unless addressed, the U.S. government may add over $6 billion of debt every day for the next ten years—borrowing over $268 million every hour.19

DOGE has wasted no time in getting started. According to the department, they are already saving the federal government approximately $1 billion per day, mostly from the federal hiring freeze, eliminating DEI initiatives, and preventing improper payments to foreign organizations, per presidential executive orders.20 DOGE has begun to scrutinize and clean up the federal real estate portfolio, which has more than 7,500 leases. According to the department, landlords in Washington, D.C. that rent to federal agencies are being paid a significant premium: the average General Services Administration (GSA) office rent per square foot in Washington is $41, while the average broader D.C. office market sits at $33.21,22 This follows a 2023 Public Buildings Reform Board report that found that nearly 90% of U.S. government agency space in D.C. is going unused.23 On January 21, the U.S. Debt Clock website introduced a DOGE section to monitor the department’s efforts to cut back on federal spending.24

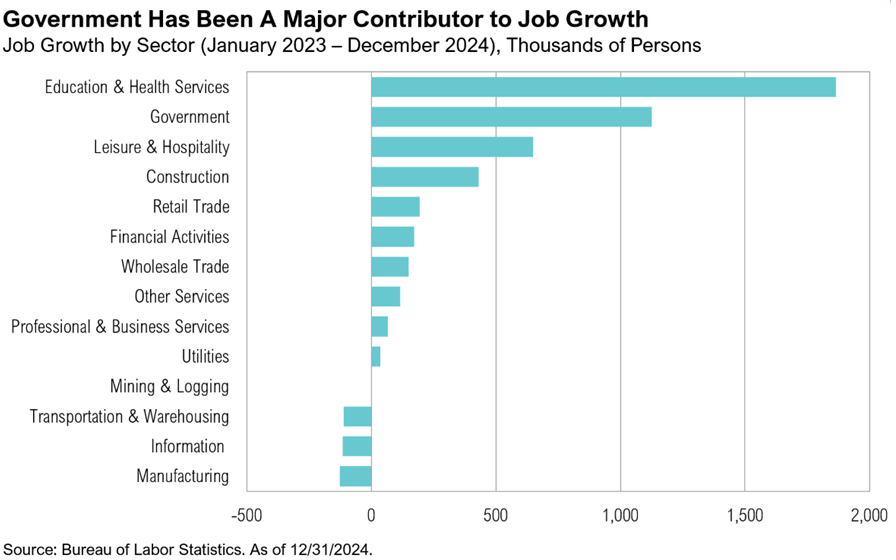

Another executive order, effective from January 20, put a hiring freeze on all federal government jobs. On January 28, the Trump administration sent out a voluntary resignation invitation to nearly every federal worker, offering employees continued payment until September 2025 if they resigned by February 6.25 The administration anticipates that between 5% and 10% of the federal workforce may quit, which could lead to approximately $100 billion in savings.25,26 Over the past two years, the government sector has been the second-largest contributor to job growth, adding over 1.1 million new federal employees since January 2023.

Recent reports have also revealed misspending in various government departments. For instance, the Government Accountability Office in December released a report that nearly $100 billion in improper payments were made in the Medicare and Medicaid programs in 2023 while the Department of Justice also in December sued CVS and Walgreens for filing unlawful prescriptions of opioids and seeking reimbursements from federal healthcare programs.27,28,29 The Federal Trade Commission in January sued CVS and Cigna for failing to provide requested documents related to the case.30

While these recent reports and DOGE’s efforts are small changes in the context of a nearly $2 trillion deficit, changes on the margin matter, and may eventually lead to a lightening of the U.S. fiscal burden.

Markets

International equity markets fared better than their U.S. counterparts in January. U.S. large-cap stocks ended the month up 2.8% while international developed market large cap stocks gained 5.3%. Similarly, while U.S. small-cap stocks ended the month up 2.6%, international developed market small-cap stocks ended the month up 3.5%. Emerging market stocks ended January up 1.8%, driven by strong gains in South American markets, including Brazil (+12%) and Colombia (+21%). Both U.S. intermediate-term bonds and international developed market bonds gained 0.5%.

In geopolitical developments, on January 19, a ceasefire between Israel and Hamas came into effect. After peaking at $79 per barrel on January 16, WTI crude oil ended the month down $7, easing to $72 per barrel on January 31.

Looking Forward

The incoming administration appears focused on bolstering economic growth while at the same time reducing the deficit. The most critical element of this endeavor will be curtailing the deficit and, in the process, keeping longer-term yields contained to not disrupt the economic expansion.

Although the Federal Reserve can dictate short-term interest rates through policy decisions, it has less control over longer-term rates. Since the first rate cut in September, longer-term yields have reacted with a unique vibe, moving higher than during other rate-cutting cycles. That’s not to say a rise in bond yields is bad, per se, but unless it is driven by higher long-term growth prospects that translate to higher corporate earnings, rather than fiscal irresponsibility or other perceived policy errors, it could hurt risky asset valuations. It will now be up to fiscal policymakers to thread this needle. If they can, it will allow the continuation of government policies that support economic growth, which are critical for supporting equity and credit markets. Although these are disruptive to the status quo in the short term, we view cost-saving advancements in AI and progress, even if it is marginal, on the deficit as constructive developments.

Citations

- BEA: https://www.bea.gov/sites/default/files/2025-01/gdp4q24-adv.pdf

- Reuters: https://www.reuters.com/markets/us/us-goods-trade-deficit-widens-sharply-december-imports-2025-01-29/

- ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/january/

- ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/january/

- BLS: https://www.bls.gov/news.release/cpi.nr0.htm

- FactSet: https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_013125.pdf

- Liz-Ann Sonders via X: https://x.com/LizAnnSonders/status/1885310214498385943/photo/2

- Bloomberg: https://www.bloomberg.com/news/articles/2025-01-27/what-is-deepseek-r1-and-how-does-china-s-ai-model-compare-to-openai-meta

- Reuters: https://www.reuters.com/technology/us-looking-into-whether-deepseek-used-restricted-ai-chips-source-says-2025-01-31/

- Arxiv: https://arxiv.org/html/2412.19437v1

- Marc Andreessen via X: https://x.com/pmarca/status/1883640142591853011

- CNN: https://edition.cnn.com/2024/12/02/tech/china-us-chips-new-restrictions-intl-hnk/index.html

- CNBC: https://www.cnbc.com/2025/01/24/how-chinas-new-ai-model-deepseek-is-threatening-us-dominance.html

- CNBC: https://www.cnbc.com/2025/01/28/us-navy-restricts-use-of-deepseek-ai-imperative-to-avoid-using.html

- Meta Earnings Call: https://s21.q4cdn.com/399680738/files/doc_financials/2024/q4/META-Q4-2024-Earnings-Call-Transcript.pdf

- Reuters: https://www.reuters.com/technology/artificial-intelligence/microsoft-meta-ceos-defend-hefty-ai-spending-after-deepseek-stuns-tech-world-2025-01-30/

- The White House: https://www.whitehouse.gov/presidential-actions/2025/01/the-first-100-hours-historic-action-to-kick-off-americas-golden-age/

- CBO: https://www.cbo.gov/system/files/2024-06/60039-By-the-Numbers.pdf

- Committee on Homeland Security & Governmental Affairs: https://www.hsgac.senate.gov/wp-content/uploads/FESTIVUS-REPORT-2024.pdf

- Department of Government Efficiency via X: https://x.com/DOGE/status/1884396041786524032

- Department of Government Efficiency via X: https://x.com/DOGE/status/1886273522214813785

- Trepp: https://www.trepp.com/trepptalk/doge-looks-to-cut-gsa-leased-office-space-quantifying-impact-on-key-msas

- Washington Times: https://www.washingtontimes.com/news/2024/apr/11/government-report-finds-just-12-of-federal-offices/

- U.S. National Debt Clock: https://usdebtclock.org/#

- BBC: https://www.bbc.com/news/articles/cnvqe3le3z4o

- NBC News: https://www.nbcnews.com/politics/white-house/trump-administration-offer-federal-workers-buyouts-resign-rcna189661

- GAO: https://www.gao.gov/products/gao-24-107487

- Reuters: https://www.reuters.com/business/healthcare-pharmaceuticals/us-ftc-sues-drug-gatekeepers-over-high-insulin-prices-2024-09-20/

- Fortune: https://fortune.com/2024/12/19/doj-cvs-filling-unlawful-prescriptions-opioids/

- Bloomberg Law: https://news.bloomberglaw.com/pharma-and-life-sciences/ftc-says-it-sued-cvs-cigna-over-drug-documents-for-pbm-probe

Disclosures & Definitions

Advisory Person(s) may use proprietary financial planning tools, calculators and third-party tools and materials (“Third-Party Materials”) to develop your financial planning recommendations. The projections or other information generated by Third-Party Materials regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time. Thrivent Advisor Network, LLC and its advisors do not provide legal, accounting or tax advice. Consult your attorney and or tax professional regarding these situations.

The return assumptions in Third-Party Materials are not reflective of any specific product, and do not include any fees or expenses that may be incurred by investing in specific products. The actual returns of a specific product may be more or less than the returns used. It is not possible to directly invest in an index. Financial forecasts, rates of return, risk, inflation, and other assumptions may be used as the basis for illustrations. They should not be considered a guarantee of future performance or a guarantee of achieving overall financial objectives. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment. Investing involves risks, including the possible loss of principal.

Advisory Persons of Thrivent Advisor Network provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Cedar Cove Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies.

Securities offered through Thrivent Investment Management Inc. (“TIMI”), member FINRA and SIPC, and a subsidiary of Thrivent, the marketing name for Thrivent Financial for Lutherans. Thrivent.com/disclosures. TIMI and Cedar Cove Wealth Partners are not affiliated companies.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested and cannot invest directly in an index. Opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed were or will be profitable. A summary description of the principal risks of investing in a particular model is available upon request. There can be no assurance that a model will achieve its investment objectives. Investment strategies employed by the advisor in selecting investments for the model portfolio may not result in an increase in the value of your investment or in overall performance equal to other investments. The model portfolio’s investment objectives may be changed at any time without prior notice. Portfolio allocations are based on a model portfolio, which may not be suitable for all investors. Clients should also consider the transactions costs and/or tax consequences that might result from rebalancing a model portfolio. Frequent rebalancing may incur additional costs and/or tax consequences versus less rebalancing. Please notify us if there have been any changes to your financial situation or your investment objectives, or if you would like to place or modify any reasonable restrictions on the management of your account.

Index Benchmarks presented within this report may not reflect factors relevant for your portfolio or your unique risks, goals or investment objectives. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index.

The Bloomberg U.S. Aggregate Bond® Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the U.S. bond market.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Institute for Supply Management (ISM) purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the state of the U.S. economy.

The Russell 2000® Index measures the performance of the 2,000 smaller companies that are included in the Russell 3000® Index, which itself is made up of nearly all U.S. stocks. The Russell 2000® is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market.

The S&P 500® Index, or the Standard & Poor’s 500® Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

West Texas Intermediate Index (WTI), is the main oil benchmark for North America as it is sourced from the United States, primarily from the Permian Basin. The oil comes mainly from Texas.

The Bureau of Labor Statistics (BLS) is an agency of the United States Department of Labor. It is the principal fact-finding agency in the broad field of labor economics and statistics and serves as part of the U.S. Federal Statistical System. BLS collects, calculates, analyzes, and publishes data essential to the public, employers, researchers, and government organizations.

Capitalization (Cap) is used to describe the size of the company, by market capitalization as follows:

- mega-cap: market value of $200 billion or more;

- large-cap: market value between $10 billion and $200 billion;

- mid-cap: market value between $2 billion and $10 billion;

- small-cap: market value between $250 million and $2 billion; and

- micro-cap: market value of less than $250 million

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate.

Founded in 1948, the World Health Organization (WHO) is the United Nations agency dedicated to global health and safety.